Rise in Connected Devices

The proliferation of connected devices is a primary driver for the Internet of Things (IoT) Insurance Market. As more devices become interconnected, the volume of data generated increases significantly. This data can be harnessed to assess risks more accurately, leading to tailored insurance products. For instance, the number of connected devices is projected to reach 75 billion by 2025, creating vast opportunities for insurers to develop innovative coverage options. Insurers can utilize real-time data from these devices to monitor risk factors, potentially reducing claims and enhancing customer satisfaction. This trend indicates a shift towards data-driven decision-making in the insurance sector, which could reshape traditional underwriting processes.

Advancements in Data Analytics

Advancements in data analytics are significantly influencing the Internet of Things (IoT) Insurance Market. The ability to analyze vast amounts of data generated by IoT devices allows insurers to gain insights into customer behavior and risk profiles. Predictive analytics can enhance underwriting processes, enabling insurers to offer more personalized and accurate policies. The integration of machine learning and artificial intelligence into data analytics further enhances these capabilities, allowing for real-time risk assessment. As a result, insurers can optimize their pricing strategies and improve claims management. This trend suggests that the future of the insurance industry will be heavily reliant on data-driven insights, potentially transforming how policies are developed and managed.

Regulatory Compliance and Standards

Regulatory compliance is becoming increasingly critical in the Internet of Things (IoT) Insurance Market. Governments and regulatory bodies are establishing frameworks to ensure the security and privacy of data generated by IoT devices. Insurers must navigate these regulations to offer compliant products, which can be a complex process. However, this necessity also presents an opportunity for insurers to differentiate themselves by providing solutions that not only meet regulatory requirements but also enhance customer trust. As regulations evolve, the ability to adapt and offer compliant insurance products could become a competitive advantage, potentially driving market growth. Insurers that proactively address compliance issues may find themselves better positioned in this rapidly changing landscape.

Increased Consumer Awareness and Engagement

Increased consumer awareness regarding the benefits of IoT technology is driving growth in the Internet of Things (IoT) Insurance Market. As consumers become more informed about how IoT devices can enhance their safety and security, they are more likely to seek insurance products that cover these technologies. This heightened engagement leads to a greater demand for insurance solutions that are tailored to the unique risks associated with IoT devices. Insurers are responding by creating educational campaigns and user-friendly platforms that facilitate consumer understanding of available products. This trend indicates a shift towards a more informed consumer base, which could lead to increased competition among insurers to provide innovative and relevant coverage options.

Growing Demand for Risk Management Solutions

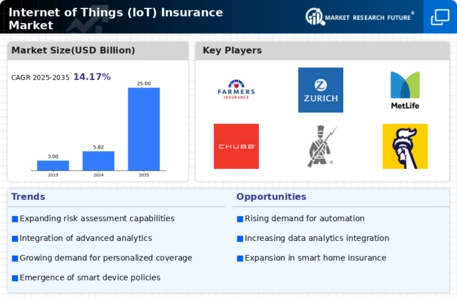

The increasing complexity of risks associated with IoT devices drives demand for specialized risk management solutions within the Internet of Things (IoT) Insurance Market. Businesses are increasingly aware of the vulnerabilities that come with interconnected systems, prompting them to seek insurance products that address these specific risks. The market for IoT insurance is expected to grow at a compound annual growth rate of over 25% in the coming years, reflecting the urgent need for comprehensive coverage. Insurers are responding by developing policies that encompass cyber threats, data breaches, and equipment malfunctions, thereby providing businesses with peace of mind. This growing demand for tailored risk management solutions is likely to propel the market forward.