Surge in Data-Driven Decision Making

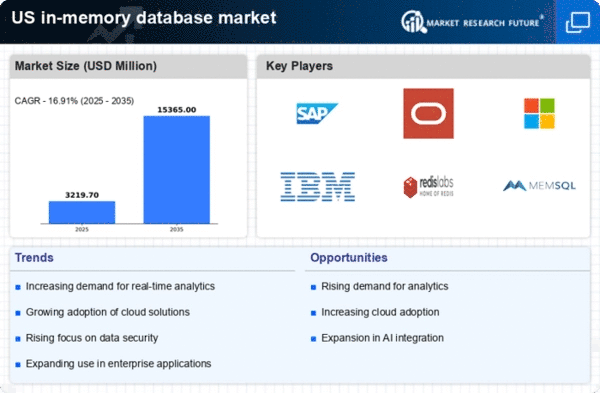

The in memory-database market is experiencing a surge in demand driven by the increasing reliance on data-driven decision making across various sectors. Organizations are recognizing the value of real-time insights to enhance operational efficiency and customer satisfaction. As businesses strive to remain competitive, the need for rapid data processing capabilities becomes paramount. According to recent estimates, the market is projected to grow at a CAGR of approximately 20% over the next five years. This growth is indicative of a broader trend where companies are investing heavily in technologies that facilitate immediate access to data, thereby propelling the in memory-database market forward. The ability to analyze large datasets in real-time is becoming a critical differentiator, suggesting that organizations that adopt these solutions may gain a competitive edge in their respective industries.

Increased Focus on Customer Experience

The in memory-database market is witnessing growth due to an increased focus on enhancing customer experience. Organizations are leveraging real-time data analytics to gain insights into customer behavior and preferences, allowing them to tailor their offerings accordingly. This shift towards customer-centric strategies is driving the demand for in memory-database solutions that can provide immediate access to relevant data. Companies that utilize these databases can respond swiftly to customer inquiries and adapt their services based on real-time feedback. As businesses prioritize customer satisfaction, the in memory-database market is likely to expand, with organizations investing in technologies that facilitate personalized experiences and foster customer loyalty.

Advancements in Technology Infrastructure

Technological advancements are significantly influencing the in memory-database market. The proliferation of high-performance computing and the development of faster processors are enabling organizations to process vast amounts of data with unprecedented speed. This evolution in technology infrastructure is crucial for businesses that require immediate access to information for decision-making. Furthermore, the integration of artificial intelligence and machine learning with in memory-database solutions is enhancing analytical capabilities, allowing for more sophisticated data processing. As organizations increasingly adopt these advanced technologies, the in memory-database market is likely to witness substantial growth. The ongoing investment in infrastructure improvements suggests a robust future for the market, as companies seek to leverage these advancements to optimize their operations and drive innovation.

Regulatory Compliance and Data Governance

The in memory-database market is also influenced by the increasing emphasis on regulatory compliance and data governance. Organizations are facing mounting pressure to adhere to various regulations regarding data privacy and security. In response, many are turning to in memory-database solutions that offer robust data management capabilities, ensuring compliance with industry standards. The ability to manage and analyze data in real-time not only aids in meeting regulatory requirements but also enhances overall data governance practices. As compliance becomes a critical concern for businesses, the demand for in memory-database solutions is expected to rise, reflecting a broader trend towards responsible data management and accountability.

Growing Need for Scalability and Flexibility

The in memory-database market is being propelled by the growing need for scalability and flexibility in data management solutions. As organizations expand, their data requirements evolve, necessitating systems that can adapt to increasing workloads without compromising performance. In this context, in memory-database solutions offer the agility required to scale operations efficiently. Businesses are increasingly seeking solutions that can accommodate fluctuating data volumes while maintaining high-speed access. This trend is particularly evident in sectors such as e-commerce and finance, where rapid data processing is essential. The market is expected to grow as more organizations recognize the advantages of scalable in memory-database solutions, which can support their dynamic operational needs and enhance overall productivity.