Escalating Geopolitical Tensions

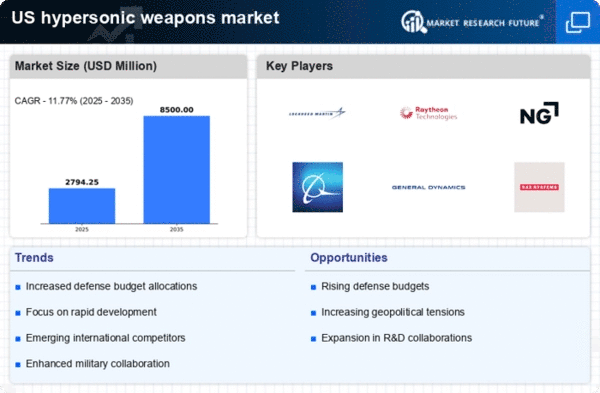

The The hypersonic weapons market is growing due to escalating geopolitical tensions among major powers. Nations are increasingly investing in advanced military capabilities to deter potential threats. The US, in particular, has recognized the strategic importance of hypersonic technology, leading to increased funding for research and development. In 2025, the US defense budget allocates approximately $3 billion for hypersonic programs, reflecting a commitment to maintaining military superiority. This investment is likely to enhance the capabilities of the hypersonic weapons market, as countries seek to develop systems that can evade traditional missile defense systems. The urgency to address perceived threats from rival nations further propels the demand for hypersonic weapons, indicating a robust growth trajectory for the industry.

Increased Focus on National Security

The hypersonic weapons market is significantly influenced by the heightened focus on national security. In light of emerging threats, the US government is prioritizing the development of advanced weaponry to ensure defense readiness. The 2025 National Defense Strategy emphasizes the need for rapid response capabilities, which hypersonic weapons can provide. This strategic shift is reflected in the allocation of resources, with the US Department of Defense earmarking over $1.5 billion for hypersonic initiatives in the current fiscal year. As national security concerns continue to rise, the demand for hypersonic weapons is expected to grow, driving innovation and investment within the industry. The emphasis on maintaining a technological edge over adversaries further underscores the importance of hypersonic capabilities in modern defense strategies.

Emerging Threats from Adversarial Nations

The emergence of threats from adversarial nations is propelling the hypersonic weapons market. Countries such as China and Russia are actively developing their own hypersonic capabilities, prompting the US to accelerate its own programs. The competitive landscape is intensifying, as these nations seek to gain strategic advantages through advanced military technologies. The US defense establishment recognizes the need to counter these developments, leading to increased funding and collaboration with private sector companies. In 2025, it is estimated that the US will invest approximately $2 billion in partnerships with defense contractors to enhance hypersonic weapon systems. This competitive dynamic is likely to drive innovation and growth within the hypersonic weapons market, as nations strive to maintain their military edge.

Technological Advancements in Defense Systems

Technological advancements play a crucial role in shaping the hypersonic weapons market. Innovations in materials science, propulsion systems, and guidance technologies are enabling the development of more effective hypersonic weapons. The US military is actively pursuing these advancements, with initiatives aimed at enhancing the speed and accuracy of hypersonic systems. For instance, the introduction of new composite materials is expected to improve the thermal resistance of hypersonic vehicles, allowing them to operate at higher speeds. As these technologies mature, they are likely to reduce costs and increase the operational capabilities of hypersonic weapons. The ongoing research and development efforts suggest a promising future for the hypersonic weapons market, as the industry adapts to the evolving landscape of modern warfare.

Integration of Hypersonic Technologies in Military Strategy

The integration of hypersonic technologies into military strategy is a key driver for the hypersonic weapons market. The US military is increasingly incorporating hypersonic capabilities into its operational frameworks, recognizing their potential to transform warfare. This strategic integration is evident in the development of multi-domain operations, where hypersonic weapons can be utilized alongside traditional systems for enhanced effectiveness. The 2025 military exercises demonstrate the US commitment to testing and refining hypersonic systems in real-world scenarios. As these technologies become more embedded in military doctrine, the demand for hypersonic weapons is expected to rise. This trend indicates a shift in how military forces approach conflict, further solidifying the role of hypersonic capabilities in future defense strategies.