Escalating Geopolitical Tensions

The Hypersonic Weapons Market is increasingly influenced by escalating geopolitical tensions among major powers. Nations are prioritizing the development of hypersonic capabilities as a deterrent against perceived threats, leading to a competitive arms race. Countries such as the United States, Russia, and China are investing substantial resources into hypersonic research and development, with military budgets reflecting this shift. For instance, recent defense budgets indicate that hypersonic weaponry is becoming a central component of national defense strategies. This environment of uncertainty and competition is likely to drive demand for hypersonic weapons, as nations seek to maintain strategic advantages over their adversaries.

Growing Focus on National Security

The Hypersonic Weapons Market is increasingly shaped by a growing focus on national security among nations. As global threats evolve, governments are compelled to enhance their military capabilities, particularly in the realm of advanced weaponry. Hypersonic weapons, with their ability to evade traditional missile defense systems, are viewed as critical assets in ensuring national security. This heightened emphasis on defense readiness is prompting nations to accelerate their hypersonic programs, with many establishing dedicated research initiatives. The potential for hypersonic weapons to alter the strategic landscape is driving investments and collaborations within the defense sector, further solidifying their role in future military operations.

Technological Advancements in Defense Systems

The Hypersonic Weapons Market is experiencing a surge in technological advancements that enhance the capabilities of defense systems. Innovations in materials science, propulsion technologies, and guidance systems are enabling the development of hypersonic weapons that can travel at speeds exceeding Mach 5. This rapid evolution is not only improving the performance of existing systems but also paving the way for new applications in military strategy. As nations invest heavily in these technologies, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 15% in the coming years. The integration of artificial intelligence and machine learning into hypersonic systems further amplifies their effectiveness, making them a focal point in modern warfare strategies.

Increased Military Budgets and Defense Spending

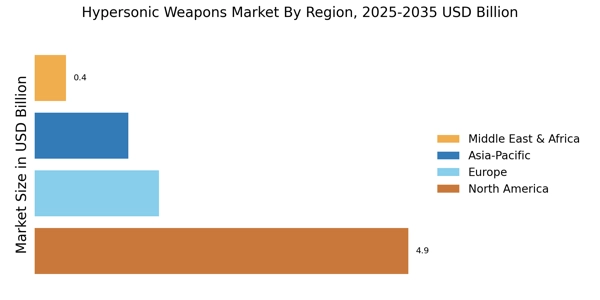

The Hypersonic Weapons Market is benefiting from increased military budgets and defense spending across various nations. Governments are recognizing the strategic importance of hypersonic technologies in modern warfare, leading to substantial investments in research, development, and procurement. Recent reports indicate that defense spending is projected to rise by approximately 3% annually, with a significant portion allocated to advanced weapon systems, including hypersonic missiles. This trend is particularly evident in countries that perceive a need to enhance their military capabilities in response to evolving threats. As defense budgets continue to expand, the hypersonic weapons sector is poised for robust growth, attracting both established defense contractors and new entrants.

Emergence of Strategic Alliances and Partnerships

The Hypersonic Weapons Market is witnessing the emergence of strategic alliances and partnerships among nations and defense contractors. Collaborative efforts are being formed to share knowledge, resources, and technology in the development of hypersonic capabilities. These partnerships are essential for pooling expertise and accelerating the pace of innovation in hypersonic weaponry. Recent agreements between countries have highlighted the importance of joint research initiatives and co-development projects, which are expected to enhance the effectiveness and reliability of hypersonic systems. As nations recognize the benefits of collaboration, the market is likely to see an increase in joint ventures and cooperative programs, further driving advancements in hypersonic technologies.