Emergence of 5G Technology

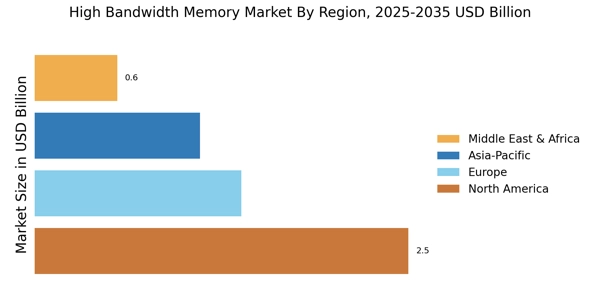

The rollout of 5G technology is poised to have a profound impact on the High Bandwidth Memory Market. With the advent of 5G, there is an anticipated increase in data transmission speeds and connectivity, which necessitates advanced memory solutions to support the enhanced performance of devices. The High Bandwidth Memory Market is expected to benefit from this trend, as 5G applications require memory that can handle large volumes of data with minimal latency. Analysts suggest that the integration of high bandwidth memory in 5G infrastructure could lead to a market expansion, as telecommunications companies seek to optimize their networks for better service delivery. This development may catalyze further innovations in memory technology, aligning with the demands of next-generation applications.

Increasing Data Processing Needs

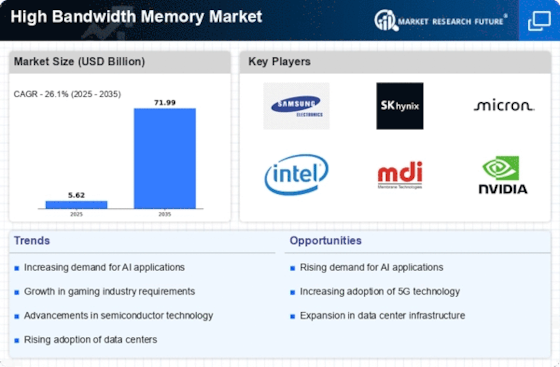

The High Bandwidth Memory Market is experiencing a surge in demand due to the increasing need for efficient data processing. As applications in artificial intelligence, machine learning, and big data analytics expand, the requirement for high-speed memory solutions becomes critical. The industry is projected to grow at a compound annual growth rate of approximately 30% over the next five years, driven by the necessity for faster data retrieval and processing capabilities. This trend indicates that organizations are prioritizing high bandwidth memory solutions to enhance their computational efficiency and performance. Consequently, the High Bandwidth Memory Market is likely to witness significant investments aimed at developing innovative memory technologies that can meet these escalating demands.

Rising Adoption of Cloud Computing

The High Bandwidth Memory Market is benefiting from the rising adoption of cloud computing services. As businesses increasingly migrate to cloud-based solutions, the demand for high-performance memory systems that can support large-scale data processing and storage is on the rise. Cloud service providers are investing heavily in infrastructure that incorporates high bandwidth memory to enhance service delivery and operational efficiency. This shift is expected to drive the market growth, as organizations seek to leverage the advantages of high bandwidth memory for improved data management and analytics capabilities. The High Bandwidth Memory Market is likely to see a robust increase in demand as cloud computing continues to evolve and expand.

Growth in Gaming and Graphics Applications

The High Bandwidth Memory Market is significantly influenced by the burgeoning gaming and graphics sectors. As gaming technology evolves, there is a growing demand for high-performance graphics processing units (GPUs) that utilize high bandwidth memory to deliver superior visual experiences. The market for gaming is projected to reach over 200 billion dollars by 2025, which underscores the potential for high bandwidth memory solutions to enhance gaming performance. Furthermore, the increasing popularity of virtual reality and augmented reality applications necessitates memory solutions that can support high data rates and low latency. This trend indicates that the High Bandwidth Memory Market is likely to see substantial growth as it caters to the needs of these dynamic sectors.

Technological Innovations in Memory Solutions

The High Bandwidth Memory Market is characterized by rapid technological innovations that are reshaping memory solutions. Advances in memory architecture, such as the development of 3D memory technologies, are enabling higher data transfer rates and improved energy efficiency. These innovations are crucial for meeting the demands of modern applications, including high-performance computing and data centers. The market is witnessing a shift towards more efficient memory solutions that can provide enhanced performance while reducing power consumption. As companies invest in research and development to create next-generation memory technologies, the High Bandwidth Memory Market is expected to experience significant growth, driven by the need for cutting-edge memory solutions.