Rising Cyber Threats

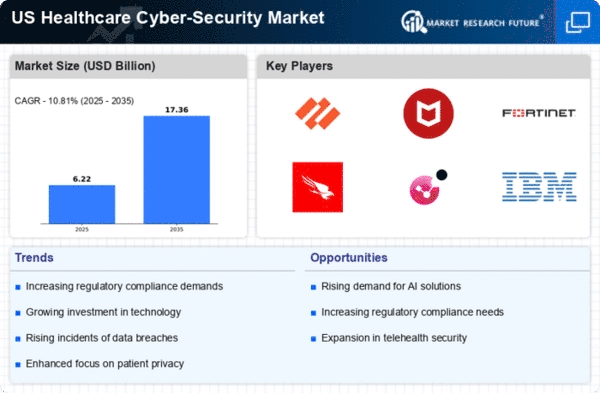

The healthcare cyber-security market is experiencing heightened demand due to the increasing frequency and sophistication of cyber threats. Healthcare organizations are prime targets for cybercriminals, as they hold sensitive patient data and critical operational information. In 2025, it is estimated that cyberattacks on healthcare entities could rise by over 30%, prompting a significant investment in cyber-security measures. This trend indicates that healthcare providers are prioritizing the protection of their digital assets, leading to a surge in the adoption of advanced security technologies. As a result, the healthcare cyber-security market is likely to expand rapidly, with organizations seeking comprehensive solutions to mitigate risks and safeguard patient information.

Technological Advancements

The healthcare cyber-security market is being driven by rapid technological advancements that enhance security measures. Innovations such as artificial intelligence (AI) and machine learning (ML) are increasingly integrated into cyber-security solutions, enabling healthcare organizations to detect and respond to threats more effectively. In 2025, the market for AI-driven cyber-security solutions is projected to grow by approximately 25%, reflecting the industry's shift towards more proactive security strategies. These technologies not only improve threat detection but also streamline compliance with regulatory requirements, making them essential for healthcare providers. Consequently, the healthcare cyber-security market is evolving to incorporate these cutting-edge technologies, ensuring robust protection against emerging threats.

Shift to Telehealth Services

The healthcare cyber-security market is experiencing a transformation due to the shift towards telehealth services. As more healthcare providers adopt telemedicine solutions, the need for robust cyber-security measures becomes paramount. In 2025, it is anticipated that telehealth services will account for over 40% of patient consultations, creating new vulnerabilities that cybercriminals may exploit. This shift necessitates the implementation of secure communication channels and data protection protocols, driving demand for specialized cyber-security solutions. Consequently, the healthcare cyber-security market is poised for growth as organizations seek to protect patient data and maintain trust in telehealth services.

Increased Regulatory Scrutiny

The healthcare cyber-security market is significantly influenced by the growing regulatory scrutiny surrounding data protection and privacy. Regulatory bodies are imposing stricter guidelines to ensure that healthcare organizations implement adequate security measures to protect patient information. In 2025, compliance costs for healthcare providers are expected to rise by 15%, as organizations invest in necessary technologies and training to meet these regulations. This increased focus on compliance not only drives demand for cyber-security solutions but also encourages healthcare entities to adopt a culture of security awareness. As a result, the healthcare cyber-security market is likely to see sustained growth as organizations strive to adhere to evolving regulatory standards.

Growing Awareness of Cyber Risks

The healthcare cyber-security market is benefiting from a growing awareness of cyber risks among healthcare professionals and administrators. As incidents of data breaches and ransomware attacks become more prevalent, organizations are increasingly recognizing the importance of investing in cyber-security measures. In 2025, surveys indicate that over 70% of healthcare executives consider cyber-security a top priority, reflecting a cultural shift towards proactive risk management. This heightened awareness is likely to drive increased spending on cyber-security solutions, as organizations seek to protect their assets and ensure compliance with regulatory requirements. Thus, the healthcare cyber-security market is expected to expand as awareness of cyber threats continues to rise.