Rising Cyber Threats

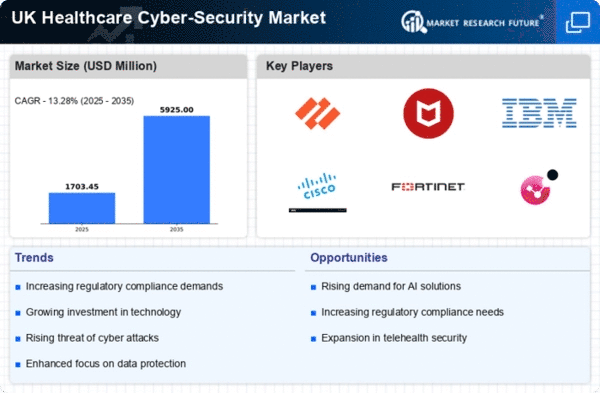

Heightened demand is due to the increasing frequency and sophistication of cyber threats. In the UK, healthcare organisations are prime targets for cybercriminals, with data breaches and ransomware attacks becoming alarmingly common. Reports indicate that over 50% of healthcare providers have faced cyber incidents in the past year. This alarming trend necessitates robust cyber-security measures to protect sensitive patient data and maintain operational integrity. As a result, investments in advanced security solutions are surging, with the market projected to grow at a CAGR of 12% over the next five years. The urgency to safeguard against these threats is driving innovation and adoption of comprehensive security frameworks within the healthcare cyber-security market.

Growing Demand for Telehealth Services

Growing demand for telehealth services in the UK is propelling the market. As healthcare providers expand their digital offerings, the need for secure platforms to protect patient information becomes paramount. The telehealth sector is projected to grow by 25% annually, necessitating enhanced cyber-security measures to safeguard sensitive data transmitted over digital channels. This surge in telehealth adoption has prompted healthcare organisations to invest in secure communication tools and data encryption technologies. The integration of these solutions is crucial for ensuring compliance with data protection regulations, thereby reinforcing the overall integrity of the healthcare cyber-security market.

Regulatory Pressure for Data Protection

Regulatory pressure for data protection in the UK significantly influences the market. With the implementation of stringent data protection laws, healthcare organisations are compelled to adopt comprehensive cyber-security measures. The General Data Protection Regulation (GDPR) mandates that organisations must ensure the confidentiality and integrity of personal data, leading to increased scrutiny and potential penalties for non-compliance. As a result, healthcare providers are investing heavily in cyber-security solutions to mitigate risks and ensure compliance. This regulatory landscape is fostering a proactive approach to cyber-security, driving growth and innovation within the healthcare cyber-security market.

Emergence of Advanced Cybersecurity Technologies

Emergence of advanced cybersecurity technologies is evolving the market. Innovations such as artificial intelligence (AI) and machine learning (ML) are being integrated into security frameworks to enhance threat detection and response capabilities. In the UK, healthcare organisations are increasingly adopting these technologies to combat sophisticated cyber threats. The market for AI-driven security solutions is expected to grow by 30% over the next three years, reflecting the industry's commitment to leveraging cutting-edge technology for improved security. This trend indicates a shift towards proactive cyber-security strategies, ultimately strengthening the resilience of the healthcare cyber-security market.

Increased Investment in Cybersecurity Infrastructure

There is a significant uptick in investment aimed at enhancing cybersecurity infrastructure. UK healthcare providers are allocating substantial budgets to fortify their cyber defenses, with spending expected to reach £1.5 billion by 2026. This investment is driven by the need to comply with stringent regulations and to protect against the escalating threat landscape. Healthcare organisations are increasingly recognising that a robust cybersecurity posture is essential not only for compliance but also for maintaining patient trust. Consequently, the market is seeing a shift towards integrated security solutions that encompass threat detection, incident response, and data protection, thereby fostering a more resilient healthcare cyber-security market.