Increasing Cybersecurity Threats

The hardware encryption market is experiencing growth due to the escalating threats posed by cybercriminals. As organizations in the US face an increasing number of data breaches and ransomware attacks, the demand for robust security solutions intensifies. In 2025, it is estimated that cybercrime will cost businesses globally over $10 trillion annually, highlighting the urgency for effective data protection measures. Hardware encryption provides a reliable method to safeguard sensitive information, making it a preferred choice for enterprises. This trend is likely to drive investments in hardware encryption technologies, as companies seek to mitigate risks associated with data loss and reputational damage. The hardware encryption market is positioned to benefit from the heightened focus on cybersecurity. Organizations are prioritizing the protection of their digital assets.

Rising Awareness of Data Privacy

The hardware encryption market is benefiting from a growing awareness of data privacy among consumers and businesses alike. In recent years, high-profile data breaches have raised public consciousness regarding the importance of safeguarding personal and sensitive information. As a result, organizations are increasingly adopting hardware encryption solutions to enhance their data protection strategies. In 2025, it is anticipated that 70% of US companies will prioritize data privacy initiatives, further driving the demand for hardware encryption technologies. This heightened focus on privacy not only influences corporate policies but also shapes consumer expectations, compelling businesses to invest in reliable encryption methods to maintain trust and compliance with evolving privacy regulations.

Growth of Cloud Computing Services

The hardware encryption market is significantly influenced by the rapid expansion of cloud computing services in the US. As businesses increasingly migrate their operations to the cloud, the need for secure data transmission and storage becomes paramount. In 2025, the cloud computing market is projected to reach $832 billion, with a substantial portion of this growth attributed to the demand for enhanced security measures. Hardware encryption solutions are essential for protecting data both in transit and at rest within cloud environments. This trend indicates a strong correlation between the growth of cloud services and the hardware encryption market, as organizations seek to ensure compliance with data protection regulations while leveraging the benefits of cloud technology.

Technological Innovations in Encryption

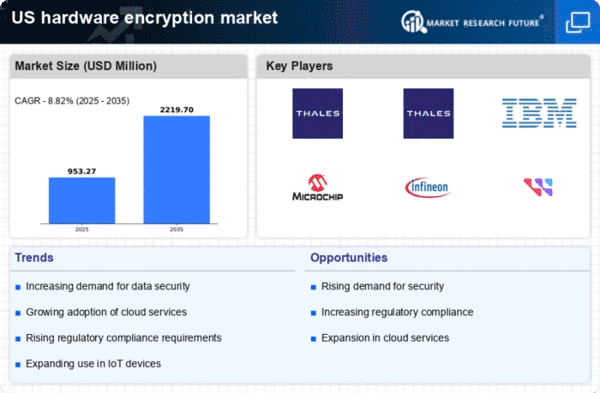

The hardware encryption market is poised for growth due to ongoing technological innovations in encryption methods and devices. Advancements in cryptographic algorithms and the development of more efficient hardware solutions are enhancing the effectiveness of encryption technologies. In 2025, the market for hardware encryption is expected to reach $5 billion, driven by innovations that improve performance and security. These advancements enable organizations to implement stronger encryption protocols, thereby addressing the increasing complexity of cyber threats. As technology continues to evolve, the hardware encryption market is likely to see a surge in demand for cutting-edge solutions that offer enhanced security features and ease of integration into existing IT infrastructures.

Regulatory Pressures for Data Protection

The hardware encryption market is significantly impacted by regulatory pressures aimed at enhancing data protection across various industries. In the US, regulations such as the California Consumer Privacy Act (CCPA) and the Health Insurance Portability and Accountability Act (HIPAA) mandate stringent data security measures. As compliance becomes a critical concern for organizations, the adoption of hardware encryption solutions is likely to increase. In 2025, it is projected that 60% of US businesses will invest in encryption technologies to meet regulatory requirements. This trend underscores the importance of hardware encryption in ensuring compliance and protecting sensitive information, thereby driving growth in the hardware encryption market.