Government Regulations and Standards

The green data-center market is significantly influenced by government regulations and standards aimed at promoting energy efficiency and sustainability. In recent years, various federal and state policies have been enacted to encourage the adoption of green technologies in data centers. For instance, regulations mandating energy efficiency benchmarks are becoming more prevalent, compelling data center operators to comply with stricter standards. By 2025, it is expected that compliance with these regulations will be a critical factor for data centers, as non-compliance could result in substantial fines and operational restrictions. Consequently, the green data-center market is likely to see increased investment in energy-efficient infrastructure and practices, as operators strive to meet regulatory requirements while enhancing their competitive edge.

Rising Demand for Sustainable Practices

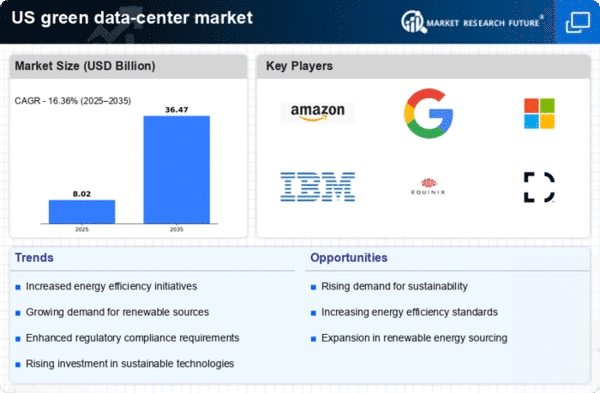

The green data-center market is experiencing a notable surge in demand for sustainable practices among businesses. Companies are increasingly prioritizing environmental responsibility, which drives the need for data centers that minimize carbon footprints. This shift is evident as organizations aim to align with consumer preferences for eco-friendly operations. In 2025, it is estimated that around 70% of enterprises in the US are actively seeking to implement sustainable IT solutions, thereby propelling the growth of the green data-center market. This trend is further supported by corporate sustainability goals, which often include commitments to reduce greenhouse gas emissions by 30% or more by 2030. As a result, the green data-center market is likely to expand as businesses invest in energy-efficient technologies and renewable energy sources.

Corporate Social Responsibility Initiatives

Corporate social responsibility (CSR) initiatives are becoming increasingly integral to business strategies, thereby impacting the green data-center market. Companies are recognizing the importance of demonstrating their commitment to sustainability, which often includes investing in green data centers. In 2025, it is anticipated that over 60% of large corporations in the US will have established CSR programs that specifically address energy consumption and environmental impact. This trend is likely to drive investments in green data centers, as organizations seek to enhance their public image and meet stakeholder expectations. Furthermore, the alignment of CSR initiatives with the green data-center market can lead to improved operational efficiencies and reduced energy costs, creating a compelling case for businesses to transition towards more sustainable data center solutions.

Growing Investment in Renewable Energy Sources

Investment in renewable energy sources is a key driver of the green data-center market. As organizations seek to reduce their reliance on fossil fuels, there is a marked shift towards integrating renewable energy into data center operations. In 2025, it is projected that approximately 40% of data centers in the US will be powered by renewable energy sources, such as solar and wind. This transition not only supports sustainability goals but also offers potential cost savings in energy expenditures. The green data-center market is likely to benefit from this trend, as companies increasingly recognize the long-term financial and environmental advantages of utilizing renewable energy. Furthermore, partnerships with renewable energy providers are becoming more common, facilitating the growth of green data centers and enhancing their overall viability.

Technological Advancements in Cooling Solutions

Innovations in cooling technologies are significantly influencing the green data-center market. Traditional cooling methods are often energy-intensive, leading to increased operational costs and environmental impact. However, advancements such as liquid cooling and evaporative cooling systems are emerging as viable alternatives. These technologies can reduce energy consumption by up to 50%, making them attractive options for data center operators. In 2025, the adoption of these advanced cooling solutions is projected to increase, as they not only enhance energy efficiency but also contribute to the overall sustainability of data centers. The green data-center market is likely to benefit from these innovations, as they align with the growing emphasis on reducing energy usage and operational costs while maintaining optimal performance.