Growing Demand for Compact Substation Solutions

In urban areas, the gas insulated-substation market is witnessing a growing demand for compact substation solutions. As cities expand and space becomes increasingly limited, utilities are turning to gas insulated substations due to their smaller footprint compared to traditional air-insulated substations. This compactness allows for easier integration into urban environments, where land is at a premium. The market for gas insulated substations is expected to reach approximately $5 billion by 2030, reflecting a shift towards more space-efficient energy solutions. Additionally, the ability to install these substations in densely populated areas without significant disruption is likely to further drive their adoption in the coming years.

Technological Advancements in Substation Design

The gas insulated-substation market is experiencing a surge in technological advancements that enhance the efficiency and reliability of substations. Innovations such as digital monitoring systems and advanced insulation materials are being integrated into new designs. These advancements not only improve operational performance but also reduce maintenance costs. The market was projected to grow at a CAGR of approximately 6.5% from 2025 to 2030, driven by these technological improvements. Furthermore, the adoption of smart grid technologies is likely to create a more resilient energy infrastructure, thereby increasing the demand for gas insulated substations. As utilities seek to modernize their grid systems, the gas insulated-substation market is positioned to benefit significantly from these trends.

Rising Investment in Renewable Energy Integration

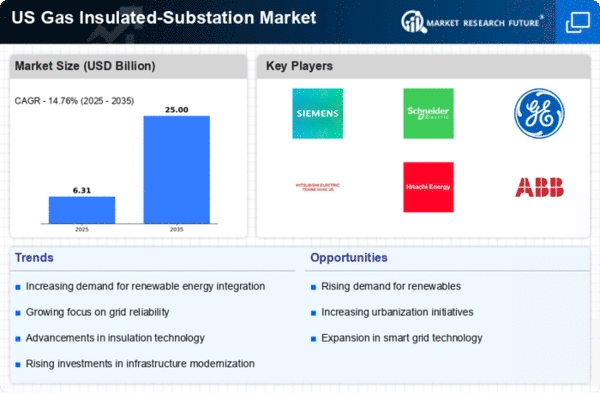

The gas insulated-substation market is benefiting from rising investments in renewable energy integration. As the US transitions towards cleaner energy sources, the need for efficient substations that can handle variable power inputs from renewable sources is becoming critical. Gas insulated substations offer the flexibility and reliability required for integrating solar and wind energy into the grid. The market is projected to expand significantly, with estimates suggesting a growth rate of around 7% annually as utilities seek to modernize their infrastructure to accommodate renewable energy. This shift not only supports sustainability goals but also enhances the overall efficiency of the energy grid.

Increased Focus on Grid Reliability and Resilience

The gas insulated-substation market is being propelled by an increased focus on grid reliability and resilience. As the demand for uninterrupted power supply grows, utilities are investing in infrastructure that can withstand extreme weather events and other disruptions. Gas insulated substations, known for their robustness and ability to operate in harsh conditions, are becoming a preferred choice. The market is anticipated to grow as utilities prioritize investments in resilient infrastructure, with projections indicating a potential increase in market size by 20% over the next five years. This trend underscores the importance of reliable energy systems in maintaining economic stability and public safety.

Regulatory Frameworks Supporting Infrastructure Development

The gas insulated-substation market is influenced by regulatory frameworks that support infrastructure development. Government policies aimed at modernizing the energy grid and promoting clean energy initiatives are creating a favorable environment for investment in gas insulated substations. Incentives and funding programs are being introduced to encourage utilities to upgrade their infrastructure. The market is expected to see a boost in growth, with projections indicating an increase in investment by approximately $3 billion over the next five years. This regulatory support is crucial for ensuring that utilities can meet the evolving demands of energy consumers while maintaining compliance with environmental standards.