Health and Wellness Trends

Health and wellness trends are increasingly shaping the foodservice coffee market, as consumers become more health-conscious. There is a growing interest in coffee products that offer functional benefits, such as organic, low-calorie, or fortified options. This shift is prompting foodservice providers to diversify their coffee menus to include healthier alternatives, which may appeal to a broader audience. In 2025, it is projected that health-oriented coffee products will represent around 20% of the foodservice coffee market. By incorporating these options, businesses can attract health-conscious consumers while also differentiating themselves in a competitive market. This trend underscores the importance of aligning product offerings with consumer values and preferences.

Rise of On-the-Go Consumption

The foodservice coffee market is witnessing a shift towards on-the-go consumption, driven by the fast-paced lifestyles of consumers. With an increasing number of individuals seeking convenience, coffee shops and foodservice providers are adapting their offerings to cater to this demand. Ready-to-drink coffee products and portable coffee solutions are gaining traction, reflecting a broader trend in the foodservice coffee market. In 2025, it is estimated that on-the-go coffee sales will account for approximately 30% of total coffee sales in the US. This trend encourages foodservice operators to innovate their product lines, ensuring that they provide quick, high-quality coffee options that align with consumer preferences for convenience and speed.

Expansion of Coffee Shop Chains

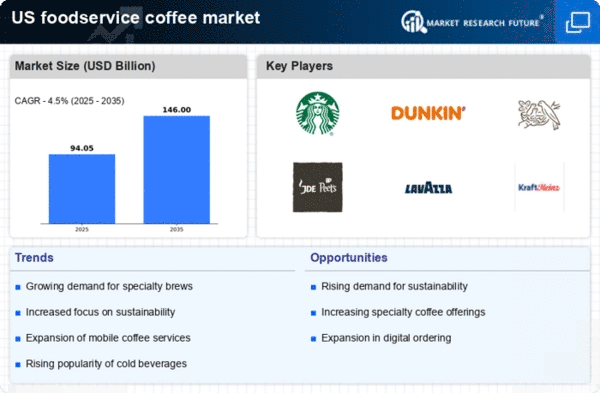

The proliferation of coffee shop chains significantly influences the foodservice coffee market. Major players such as Starbucks and Dunkin' have expanded their footprints across the US, creating a competitive landscape that drives innovation and variety in coffee offerings. This expansion is supported by a growing consumer base that frequents these establishments for both coffee and social experiences. In 2025, the coffee shop segment is projected to generate over $45 billion in revenue, highlighting its importance within the foodservice coffee market. The presence of these chains not only increases accessibility to quality coffee but also sets trends that smaller establishments often follow, thereby shaping consumer expectations and preferences.

Growing Demand for Quality Coffee

The foodservice coffee market experiences a notable increase in demand for high-quality coffee products. Consumers are increasingly discerning, seeking premium coffee experiences that emphasize flavor, origin, and brewing methods. This trend is reflected in the rising sales of specialty coffee, which accounted for approximately 55% of the total coffee market in the US. As consumers prioritize quality over quantity, foodservice establishments are compelled to adapt their offerings to meet these expectations. This shift not only enhances customer satisfaction but also drives higher profit margins for businesses that invest in quality sourcing and preparation. The foodservice coffee market must therefore focus on curating unique coffee experiences that resonate with the evolving preferences of consumers.

Influence of Social Media Marketing

Social media marketing plays a pivotal role in shaping consumer perceptions and driving engagement within the foodservice coffee market. Platforms such as Instagram and TikTok have become essential tools for coffee brands to showcase their products and connect with consumers. The visual nature of these platforms allows for creative marketing strategies that highlight unique coffee offerings and experiences. In 2025, it is estimated that over 70% of coffee consumers in the US are influenced by social media when making purchasing decisions. This trend emphasizes the need for foodservice coffee market players to leverage social media effectively, creating compelling content that resonates with their target audience and enhances brand loyalty.