Foodservice Channel Market Summary

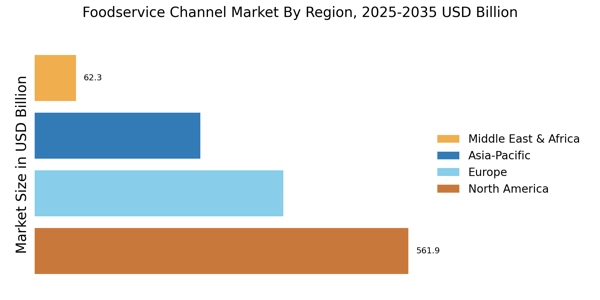

As per Market Research Future analysis, the Foodservice Channel Market Size was estimated at 1246.54 USD Billion in 2024. The Foodservice Channel industry is projected to grow from 1570.66 USD Billion in 2025 to 15843.76 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 26.0% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Foodservice Channel Market is experiencing a dynamic shift towards sustainability and technology integration.

- Sustainability initiatives are becoming increasingly prevalent in North America, reflecting a broader consumer demand for eco-friendly practices.

- Technological integration is reshaping operations in restaurants, enhancing efficiency and customer engagement.

- Health-conscious offerings are gaining traction, particularly in the Asia-Pacific region, as consumers prioritize wellness in their dining choices.

- The rise of delivery and takeout services, driven by evolving consumer preferences and a focus on sustainability practices, is significantly influencing market growth.

Market Size & Forecast

| 2024 Market Size | 1246.54 (USD Billion) |

| 2035 Market Size | 15843.76 (USD Billion) |

| CAGR (2025 - 2035) | 26.0% |

Major Players

Sysco Corporation (US), US Foods Holding Corp (US), Performance Food Group Company (US), Gordon Food Service (US), PFG Customized Distribution (US), Martin Brower (US), Darden Restaurants, Inc. (US), Aramark (US), Compass Group PLC (GB), Sodexo SA (FR)