Rising Demand for Advanced Diagnostic Tools

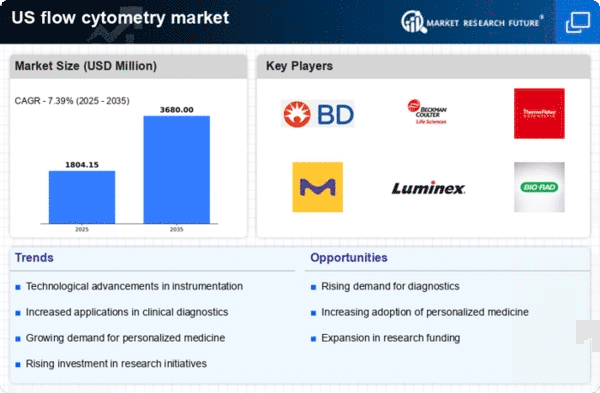

The flow cytometry market is experiencing a notable surge in demand for advanced diagnostic tools, driven by the increasing prevalence of chronic diseases such as cancer and autoimmune disorders. As healthcare providers seek more precise and efficient diagnostic methods, flow cytometry offers a robust solution for cell analysis and immunophenotyping. The market is projected to grow at a CAGR of approximately 8.5% from 2025 to 2030, reflecting the growing reliance on sophisticated technologies in clinical laboratories. This trend is further supported by the need for rapid and accurate results, which flow cytometry can deliver, thereby enhancing patient outcomes. Consequently, the flow cytometry market is positioned to expand significantly as healthcare systems prioritize innovative diagnostic solutions.

Emergence of Point-of-Care Testing Solutions

The flow cytometry market is witnessing a shift towards the emergence of point-of-care testing solutions, which offer rapid and convenient diagnostic capabilities. This trend is driven by the increasing demand for timely medical interventions and the need for portable diagnostic tools in various healthcare settings. Flow cytometry technologies are being adapted for point-of-care applications, enabling healthcare providers to perform complex analyses at the patient's bedside. The convenience and efficiency of these solutions are likely to enhance patient satisfaction and improve clinical outcomes. As the US healthcare system continues to evolve, the integration of flow cytometry into point-of-care testing is expected to gain traction, thereby contributing to the overall growth of the flow cytometry market.

Expansion of Research Activities in Life Sciences

The flow cytometry market is benefiting from the expansion of research activities in life sciences, particularly in the fields of immunology, oncology, and stem cell research. Academic and research institutions are increasingly utilizing flow cytometry for its ability to analyze multiple parameters of single cells, which is crucial for understanding complex biological processes. In the US, funding for life sciences research has seen a steady increase, with federal grants and private investments contributing to the growth of this sector. This influx of resources enables researchers to adopt advanced flow cytometry technologies, thereby driving market growth. The integration of flow cytometry in various research applications is likely to enhance its adoption, further solidifying its role in the life sciences research landscape.

Increased Investment in Healthcare Infrastructure

The flow cytometry market is expected to grow due to increased investment in healthcare infrastructure across the US. Government initiatives and private sector funding are directed towards enhancing laboratory capabilities and expanding diagnostic services. This investment is particularly evident in the establishment of advanced clinical laboratories equipped with state-of-the-art flow cytometry systems. As healthcare facilities upgrade their technologies, the adoption of flow cytometry is expected to rise, facilitating improved patient care and diagnostic accuracy. The US healthcare expenditure is projected to exceed $4 trillion by 2026, which may provide a favorable environment for the flow cytometry market to thrive as facilities seek to incorporate cutting-edge technologies.

Growing Focus on Drug Development and Clinical Trials

The flow cytometry market is significantly influenced by the growing focus on drug development and clinical trials, particularly in the biopharmaceutical sector. As companies strive to bring innovative therapies to market, the need for efficient and reliable analytical methods becomes paramount. Flow cytometry plays a critical role in assessing drug efficacy and safety through cellular analysis, which is essential during the clinical trial phases. The US biopharmaceutical industry is projected to reach a market value of over $500 billion by 2026, indicating a robust environment for flow cytometry applications. This trend suggests that as drug development accelerates, the demand for flow cytometry technologies will likely increase, further propelling market growth.