Increased Focus on Cybersecurity

The US Fiber Optic Market is increasingly influenced by the heightened focus on cybersecurity measures. As cyber threats continue to evolve, organizations are prioritizing secure data transmission methods to protect sensitive information. Fiber optic technology is inherently more secure than traditional copper networks, as it is less susceptible to interception and hacking. This characteristic makes fiber optics an attractive option for businesses and government agencies that require secure communication channels. Furthermore, the growing awareness of data privacy regulations and compliance requirements is prompting organizations to invest in fiber optic infrastructure to enhance their cybersecurity posture. As a result, the US Fiber Optic Market is likely to see increased demand for fiber optic solutions that not only provide high-speed connectivity but also ensure the security of data in transit.

Rising Adoption of Cloud Services

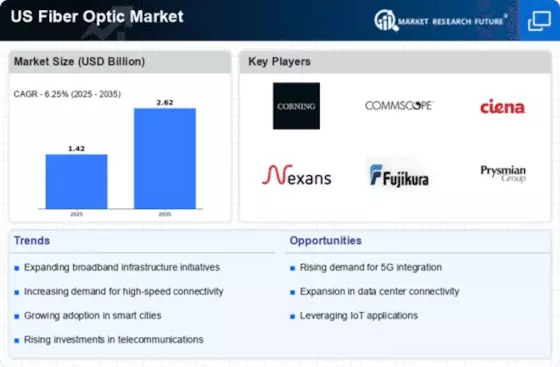

The US Fiber Optic Market is witnessing a notable increase in the adoption of cloud services, which is driving the demand for robust fiber optic infrastructure. As businesses increasingly migrate their operations to the cloud, the need for high-speed, reliable internet connections becomes critical. Fiber optic technology offers the necessary bandwidth and low latency required for seamless cloud computing experiences. According to industry reports, the cloud services market in the US is projected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years. This growth is likely to spur investments in fiber optic networks, as service providers seek to enhance their offerings and meet the evolving needs of their customers. Consequently, the US Fiber Optic Market is expected to benefit from this trend, as more organizations recognize the importance of fiber optics in supporting their digital transformation initiatives.

Increased Demand for High-Speed Internet

The US Fiber Optic Market is experiencing a surge in demand for high-speed internet services. As more consumers and businesses rely on digital connectivity, the need for faster and more reliable internet has become paramount. According to recent data, approximately 90% of American households now utilize the internet, with a significant portion requiring high-speed access for activities such as streaming, remote work, and online education. This growing demand is driving investments in fiber optic infrastructure, as it offers superior bandwidth and lower latency compared to traditional copper networks. Consequently, telecommunications companies are increasingly deploying fiber optic solutions to meet consumer expectations and remain competitive in the market. The expansion of fiber optic networks is not only enhancing user experiences but also fostering economic growth by enabling new technologies and services that depend on high-speed internet access.

Technological Innovations and Applications

The US Fiber Optic Market is propelled by continuous technological innovations that enhance the capabilities and applications of fiber optic systems. Advancements in fiber optic technology, such as the development of higher capacity fibers and improved signal processing techniques, are enabling faster data transmission and more efficient network management. For example, the introduction of Dense Wavelength Division Multiplexing (DWDM) technology allows multiple data streams to be transmitted simultaneously over a single fiber, significantly increasing network capacity. Additionally, the rise of smart cities and the Internet of Things (IoT) is creating new opportunities for fiber optic deployment, as these technologies require robust and reliable connectivity. As a result, the US Fiber Optic Market is likely to expand, driven by the demand for innovative solutions that support emerging applications and enhance overall network performance.

Government Initiatives to Expand Broadband Access

The US Fiber Optic Market is significantly influenced by government initiatives aimed at expanding broadband access across the nation. Federal and state governments have recognized the importance of high-speed internet as a critical utility, leading to various funding programs and policy measures designed to enhance connectivity in underserved areas. For instance, the Federal Communications Commission (FCC) has allocated billions of dollars to support broadband expansion projects, particularly in rural and low-income regions. These initiatives are expected to stimulate the deployment of fiber optic networks, as they provide the necessary financial support for infrastructure development. As a result, the US Fiber Optic Market is likely to witness accelerated growth, with increased investments in fiber optic technology to bridge the digital divide and ensure equitable access to high-speed internet for all citizens.