Rising Demand for Data Centers

The Fiber Optic Cable Assemblies Market is significantly influenced by the escalating demand for data centers. As businesses continue to digitize their operations, the need for efficient data storage and processing solutions has surged. Fiber optic cables are integral to data center infrastructure, providing the necessary speed and reliability for data transmission. Recent statistics indicate that the data center market is expanding rapidly, with projections suggesting a compound annual growth rate that underscores the increasing reliance on fiber optic technology. This trend is further fueled by the rise of cloud computing and big data analytics, which necessitate high-performance connectivity solutions. Consequently, the fiber optic cable assemblies market is poised to benefit from this growing demand, as organizations seek to enhance their data handling capabilities.

Government Initiatives and Investments

The Fiber Optic Cable Assemblies Market is bolstered by various government initiatives aimed at enhancing telecommunications infrastructure. Governments worldwide are recognizing the importance of robust connectivity for economic growth and social development. Investments in fiber optic networks are being prioritized, with numerous projects underway to expand broadband access in underserved areas. These initiatives not only aim to improve internet speeds but also to foster innovation and competitiveness in the digital economy. Recent reports indicate that government funding for fiber optic infrastructure is on the rise, reflecting a commitment to modernizing communication networks. As these projects materialize, the demand for fiber optic cable assemblies is likely to increase, presenting opportunities for manufacturers and service providers in the market.

Technological Advancements in Fiber Optics

The Fiber Optic Cable Assemblies Market is witnessing a wave of technological advancements that are enhancing the performance and efficiency of fiber optic solutions. Innovations such as improved manufacturing techniques and the development of new materials are contributing to the production of more durable and efficient fiber optic cables. These advancements are crucial in meeting the growing demands for higher data rates and longer transmission distances. Furthermore, the integration of advanced technologies such as wavelength division multiplexing is enabling more data to be transmitted simultaneously over a single fiber, thereby increasing overall network capacity. As these technologies evolve, they are likely to drive further adoption of fiber optic assemblies, positioning the market for sustained growth in the coming years.

Growing Need for Enhanced Security Solutions

The Fiber Optic Cable Assemblies Market is increasingly influenced by the growing need for enhanced security solutions in data transmission. Fiber optic cables offer superior security features compared to traditional copper cables, as they are less susceptible to tapping and interference. This characteristic is particularly appealing to sectors that handle sensitive information, such as finance, healthcare, and government. As cyber threats continue to evolve, organizations are prioritizing secure communication channels, which is driving the demand for fiber optic solutions. Recent analyses suggest that the market for secure data transmission is expanding, with fiber optic technology playing a pivotal role in safeguarding information. Consequently, the emphasis on security is likely to propel the growth of the fiber optic cable assemblies market, as businesses seek reliable and secure connectivity options.

Increasing Adoption of Fiber Optic Technology

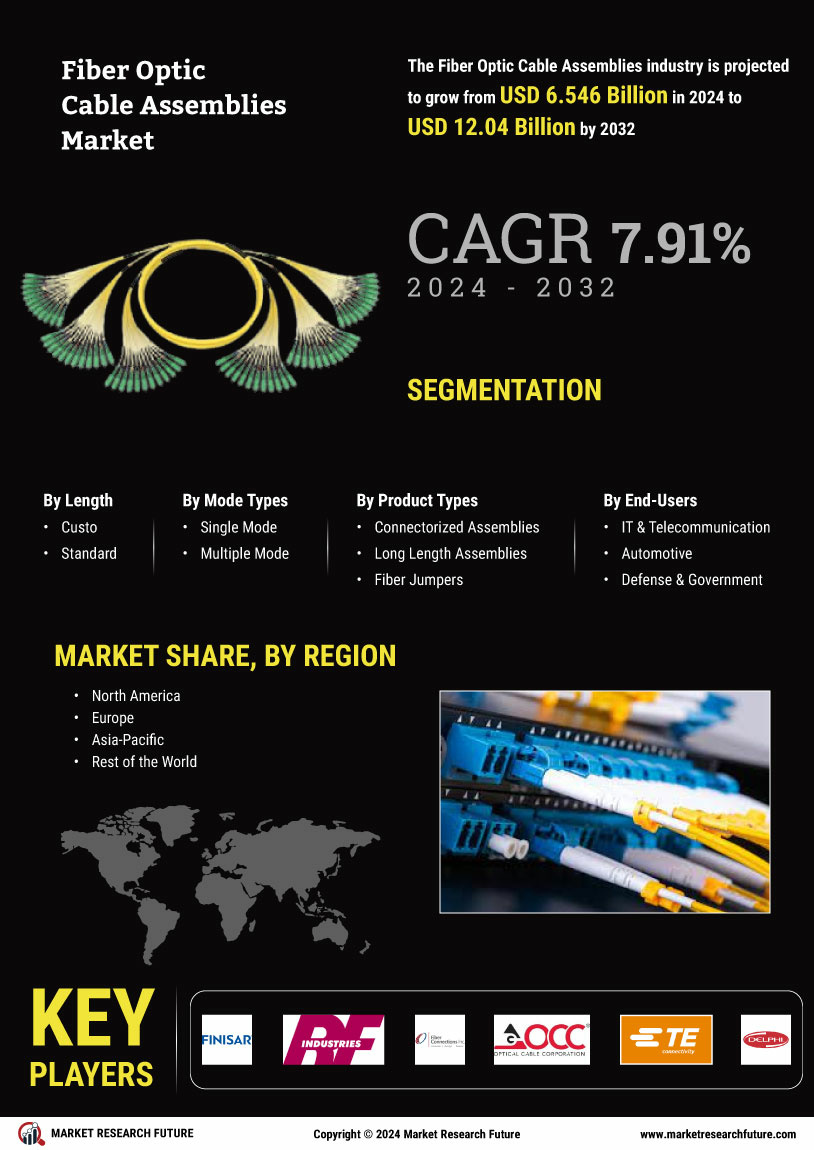

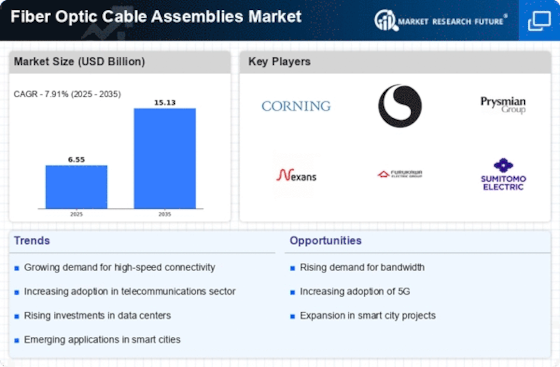

The Fiber Optic Cable Assemblies Market is experiencing a notable shift towards the adoption of fiber optic technology across various sectors. This trend is driven by the need for high-speed data transmission and improved bandwidth capabilities. As organizations increasingly rely on digital communication, the demand for fiber optic solutions is projected to grow. According to recent data, the market for fiber optic cables is expected to reach substantial figures, indicating a robust growth trajectory. This adoption is not limited to telecommunications but extends to sectors such as healthcare, education, and manufacturing, where reliable and fast connectivity is paramount. The versatility of fiber optic assemblies in supporting diverse applications further enhances their appeal, suggesting a sustained upward trend in the market.