Advancements in Payload Technology

Innovations in payload technology are significantly shaping the drone payload market. The development of lightweight materials and advanced sensors enhances the capabilities of drones, allowing them to carry heavier payloads while maintaining efficiency. For instance, the introduction of modular payload systems enables drones to adapt to various applications, from agricultural monitoring to emergency response. This flexibility is crucial as industries seek tailored solutions for specific needs. The market for drone payloads is expected to reach $1.5 billion by 2027, reflecting the growing interest in specialized payloads that can accommodate diverse operational requirements. As technology continues to evolve, the potential for increased payload capacity and functionality will likely drive further investment in the drone payload market.

Integration of AI and Data Analytics

The integration of artificial intelligence (AI) and data analytics into drone operations is emerging as a pivotal driver for the drone payload market. AI enhances the capabilities of drones by enabling real-time data processing and decision-making, which is particularly beneficial for applications such as surveillance, mapping, and environmental monitoring. The market for AI-driven drone payloads is projected to grow significantly, with estimates suggesting a potential increase of 40% over the next few years. This growth is fueled by the demand for more intelligent systems that can analyze data on-the-fly and provide actionable insights. As industries recognize the value of data-driven decision-making, the adoption of AI-enhanced payloads will likely become a key factor in the evolution of the drone payload market.

Increased Demand for Delivery Services

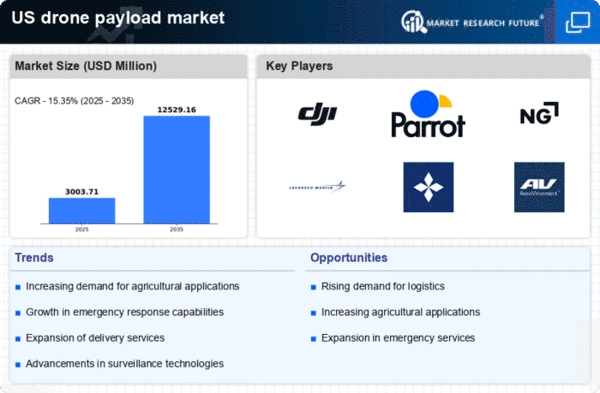

The surge in e-commerce has catalyzed a notable increase in demand for efficient delivery services, thereby impacting the drone payload market. As consumers increasingly expect rapid delivery, businesses are exploring drone technology to meet these expectations. The drone payload market is projected to witness a growth rate of approximately 25% annually, driven by the need for faster logistics solutions. Companies are investing in drone technology to enhance their delivery capabilities, which necessitates the development of specialized payloads. This trend indicates a shift towards integrating drones into supply chains, where payload capacity and efficiency become critical factors. The ability to transport goods quickly and reliably positions drones as a viable alternative to traditional delivery methods, further solidifying their role in the logistics sector.

Growing Interest in Agricultural Applications

The agricultural sector's increasing interest in drone technology is a significant driver for the drone payload market. Farmers are adopting drones for precision agriculture, utilizing payloads equipped with sensors and imaging technology to monitor crop health and optimize resource use. This trend is expected to expand, with the drone payload market projected to grow by 30% in the agricultural segment alone over the next five years. Drones equipped with specialized payloads can deliver fertilizers, pesticides, and even seeds, enhancing efficiency and reducing labor costs. As the agricultural industry seeks innovative solutions to improve yields and sustainability, the demand for advanced drone payloads will likely continue to rise, positioning drones as essential tools in modern farming.

Emerging Applications in Infrastructure Inspection

The drone payload market is experiencing growth due to the increasing adoption of drones for infrastructure inspection. Industries such as construction, energy, and telecommunications are leveraging drones equipped with high-resolution cameras and sensors to conduct inspections of bridges, power lines, and cell towers. This method offers a safer and more efficient alternative to traditional inspection techniques. The market for drone payloads in infrastructure inspection is anticipated to grow by 20% annually, driven by the need for regular maintenance and compliance with safety regulations. As organizations seek to reduce costs and improve inspection accuracy, the demand for specialized payloads that can capture detailed data will likely increase, further solidifying the role of drones in infrastructure management.