Advancements in Regulatory Frameworks

The UAV Payload and Subsystems Market is also shaped by advancements in regulatory frameworks that govern UAV operations. As regulations become more defined and supportive of UAV usage, there is a corresponding increase in market opportunities for payload developers. Governments are recognizing the potential benefits of UAV technology across various sectors, leading to the establishment of clearer guidelines for commercial and recreational use. This regulatory evolution is likely to encourage investment in UAV payloads, as companies seek to comply with new standards while maximizing operational capabilities. The establishment of a favorable regulatory environment is expected to stimulate growth in the UAV payload market, fostering innovation and expanding application areas.

Growth in Commercial UAV Applications

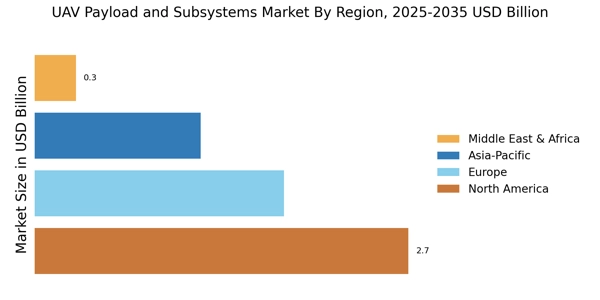

The UAV Payload and Subsystems Market is witnessing a notable expansion due to the growth in commercial UAV applications. Industries such as agriculture, logistics, and infrastructure inspection are increasingly utilizing UAVs for various tasks, including crop monitoring, package delivery, and structural assessments. The demand for specialized payloads that cater to these applications is on the rise, as businesses seek to improve efficiency and reduce operational costs. Market analysis indicates that the commercial UAV sector is projected to grow significantly, with payload systems playing a crucial role in this expansion. This trend highlights the importance of developing versatile and adaptable payloads that can meet the diverse needs of commercial users.

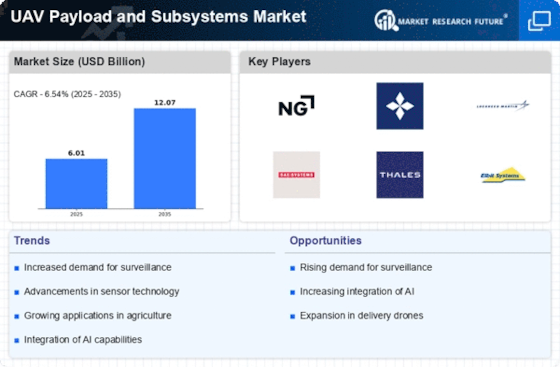

Technological Innovations in UAV Payloads

The UAV Payload and Subsystems Market is experiencing a surge in technological innovations, particularly in sensor and imaging technologies. Advanced payloads, such as high-resolution cameras and multispectral sensors, are becoming increasingly prevalent. These innovations enhance the capabilities of UAVs in various applications, including agriculture, surveillance, and disaster management. The integration of artificial intelligence and machine learning into payload systems is also noteworthy, as it allows for real-time data processing and analysis. According to recent data, the market for UAV payloads is projected to grow at a compound annual growth rate of over 15% in the coming years, driven by these technological advancements. This growth indicates a robust demand for sophisticated payload systems that can meet the evolving needs of various industries.

Increased Investment in Research and Development

The UAV Payload and Subsystems Market is benefiting from increased investment in research and development activities. Companies are allocating substantial resources to innovate and enhance payload technologies, aiming to create more efficient and effective systems. This investment is crucial for developing next-generation payloads that can perform complex tasks, such as autonomous navigation and advanced data analytics. Recent reports indicate that R&D spending in the UAV sector is on the rise, reflecting a commitment to pushing the boundaries of what UAVs can achieve. This focus on innovation is likely to drive the growth of the UAV payload market, as new technologies emerge to meet the demands of various industries.

Rising Demand for Surveillance and Reconnaissance

The UAV Payload and Subsystems Market is significantly influenced by the rising demand for surveillance and reconnaissance applications. Military and defense sectors are increasingly adopting UAVs equipped with advanced payloads for intelligence gathering and monitoring purposes. The need for enhanced situational awareness and real-time data collection is driving investments in UAV technology. Recent statistics suggest that military spending on UAV systems is expected to reach unprecedented levels, with a substantial portion allocated to payload development. This trend indicates a strong market potential for UAV payloads designed specifically for surveillance and reconnaissance missions, as defense organizations seek to enhance their operational capabilities and maintain strategic advantages.