Consumer Demand for Sustainable Solutions

The growing consumer demand for sustainable solutions is a pivotal driver in the US Diesel Engine Catalyst Market. As awareness of environmental issues increases, consumers are increasingly favoring products that contribute to lower emissions and improved fuel efficiency. This shift in consumer preferences is prompting manufacturers to invest in cleaner diesel technologies, including advanced catalysts that reduce harmful emissions. In 2025, a survey indicated that over 70% of consumers are willing to pay a premium for vehicles equipped with environmentally friendly technologies. This trend is likely to encourage automakers to incorporate advanced diesel catalysts in their vehicles, thereby expanding the market. The alignment of consumer demand with sustainability goals is expected to foster innovation and drive growth in the diesel catalyst sector.

Government Incentives and Support Programs

Government incentives and support programs play a crucial role in shaping the US Diesel Engine Catalyst Market. Federal and state governments are increasingly offering financial incentives for the adoption of cleaner technologies, including diesel catalysts. Programs aimed at reducing emissions from heavy-duty vehicles are encouraging fleet operators to upgrade their engines and exhaust systems. In 2025, it is anticipated that funding for such initiatives will increase, further driving the demand for advanced diesel catalysts. These incentives not only lower the financial burden on operators but also promote the transition to cleaner technologies. As a result, the market is likely to benefit from enhanced investment in catalyst development and deployment, fostering a more sustainable transportation sector.

Regulatory Compliance and Emission Standards

The US Diesel Engine Catalyst Market is significantly influenced by stringent regulatory compliance and emission standards set forth by the Environmental Protection Agency (EPA). These regulations mandate reductions in nitrogen oxides (NOx) and particulate matter (PM) emissions from diesel engines. As a result, manufacturers are compelled to adopt advanced catalyst technologies to meet these requirements. The market is projected to grow as companies invest in innovative catalyst solutions to ensure compliance. In 2025, the EPA proposed further tightening of emission standards, which could lead to an increased demand for high-performance catalysts. This regulatory landscape not only drives innovation but also creates opportunities for market players to develop products that align with environmental goals, thereby enhancing their competitive edge.

Technological Advancements in Catalyst Design

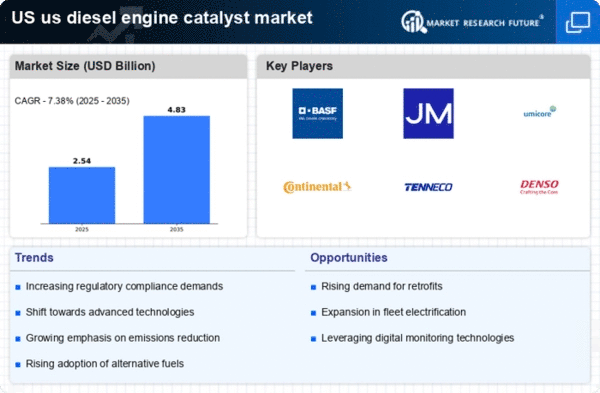

Technological advancements in catalyst design are reshaping the US Diesel Engine Catalyst Market. Innovations such as the development of more efficient catalytic converters and the integration of new materials are enhancing the performance of diesel catalysts. For instance, the introduction of platinum group metals (PGMs) in catalyst formulations has shown to improve the conversion efficiency of harmful emissions. The market is expected to witness a compound annual growth rate (CAGR) of approximately 5% from 2025 to 2030, driven by these advancements. Furthermore, research into nanotechnology and alternative catalyst materials is likely to yield products that offer superior durability and performance. As manufacturers strive to meet evolving emission standards, the focus on cutting-edge catalyst technologies will remain a key driver in the industry.

Growth of the Automotive and Transportation Sector

The growth of the automotive and transportation sector in the United States is a significant driver for the US Diesel Engine Catalyst Market. As the economy continues to recover and expand, the demand for commercial vehicles, including trucks and buses, is on the rise. This increase in vehicle production directly correlates with a heightened need for diesel engine catalysts to meet emission regulations. In 2025, the US automotive market is projected to grow by approximately 4%, further stimulating the demand for diesel catalysts. Additionally, the expansion of e-commerce and logistics services is leading to a surge in freight transportation, which relies heavily on diesel engines. Consequently, the market for diesel catalysts is likely to experience robust growth as manufacturers seek to enhance the environmental performance of their fleets.