Aging Population

The Global Dermatology Drug industry. As individuals age, they become more susceptible to various skin conditions, including age-related disorders such as skin cancer and dermatitis. The World Health Organization projects that the number of people aged 60 years and older will reach 2 billion by 2050, creating a substantial market for dermatological treatments. This demographic trend compels pharmaceutical companies to innovate and develop new therapies tailored to the needs of older patients, thereby enhancing the growth potential of the dermatology drug market.

Increase in Skin Disorders

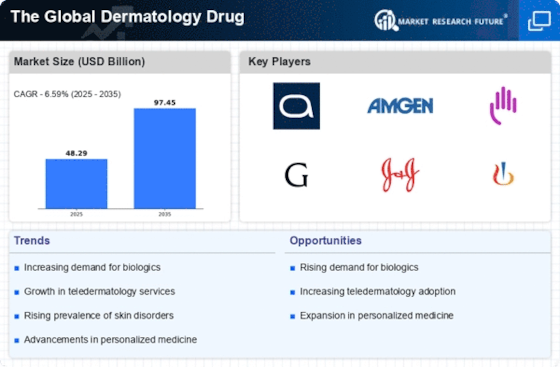

The prevalence of skin disorders, such as psoriasis, eczema, and acne, continues to rise, driving demand in the dermatology drug market. According to recent estimates, skin diseases affect nearly 900 million people worldwide, highlighting a significant patient population. This growing incidence of skin conditions necessitates the development and availability of effective treatment options. As awareness of these disorders increases, patients are more likely to seek medical advice and treatment, further propelling market growth. The dermatology drug market is thus positioned to expand as pharmaceutical companies invest in research and development to address these widespread conditions.

Rising Healthcare Expenditure

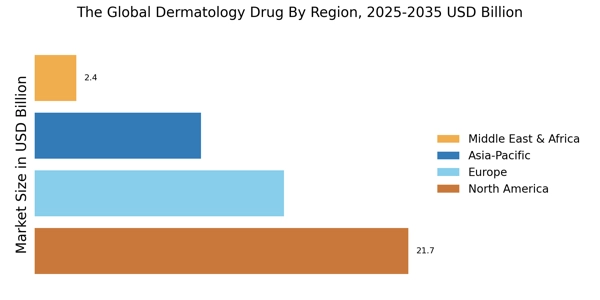

Increasing healthcare expenditure across various regions is a significant factor influencing the dermatology drug market. Governments and private sectors are allocating more resources to healthcare, which includes funding for dermatological treatments. This trend is particularly evident in developed nations, where healthcare spending is projected to grow at a compound annual growth rate of 5.4% through 2027. As healthcare budgets expand, access to dermatological care improves, leading to higher demand for dermatology drugs. Consequently, the dermatology drug market stands to benefit from this upward trajectory in healthcare investment.

Growing Demand for Cosmetic Dermatology

The rising interest in cosmetic dermatology is emerging as a vital driver for the dermatology drug market. Consumers are increasingly seeking treatments for aesthetic concerns, such as wrinkles, pigmentation, and acne scars. This trend is reflected in the growing market for cosmetic dermatological products, which is expected to reach USD 20 billion by 2026. The demand for minimally invasive procedures and effective topical treatments is on the rise, prompting pharmaceutical companies to expand their portfolios to include cosmetic solutions. Thus, the dermatology drug market is likely to see substantial growth as it adapts to the evolving preferences of consumers.

Advancements in Research and Development

Ongoing advancements in research and development are pivotal to the evolution of the dermatology drug market. Innovative technologies, such as genomics and personalized medicine, are enabling the creation of targeted therapies that offer improved efficacy and safety profiles. The market has witnessed a surge in the introduction of biologics and novel small molecules, which have transformed treatment paradigms for chronic skin conditions. As a result, the dermatology drug market is likely to experience accelerated growth, driven by the continuous influx of new and effective treatment options that cater to diverse patient needs.