Growing Aging Population

The dental implants market is experiencing growth due to the increasing aging population in the United States. As individuals age, they often face dental issues, including tooth loss, which necessitates restorative solutions. According to the U.S. Census Bureau, the population aged 65 and older is projected to reach 80 million by 2040, representing a significant segment of potential patients for dental implants. This demographic shift indicates a rising demand for dental services, particularly implants, as older adults seek to maintain their quality of life and oral health. The dental implants market is likely to benefit from this trend, as more seniors opt for durable and effective solutions to replace missing teeth, thereby driving market growth.

Increasing Dental Insurance Coverage

The expansion of dental insurance coverage is positively impacting the dental implants market. More insurance providers are beginning to include dental implants in their plans, making these procedures more accessible to a broader range of patients. This shift is particularly relevant as studies indicate that nearly 50% of Americans have some form of dental insurance, and many policies are evolving to cover advanced dental procedures. The dental implants market stands to gain from this trend, as increased insurance coverage can lead to higher patient acceptance rates for implants. Consequently, this could result in a notable increase in market revenue, potentially reaching $5 billion by 2027.

Enhanced Patient Education and Outreach

Enhanced patient education and outreach initiatives are playing a crucial role in the dental implants market. Dental professionals are increasingly focusing on informing patients about the benefits and advancements in implant technology. Educational campaigns and community outreach programs are helping to demystify the implant process, addressing common concerns and misconceptions. As patients become more informed, they are more likely to consider dental implants as a viable option for tooth replacement. The dental implants market is expected to benefit from this increased awareness, as more individuals recognize the long-term advantages of implants, potentially leading to a market expansion of 12% over the next few years.

Technological Innovations in Implantology

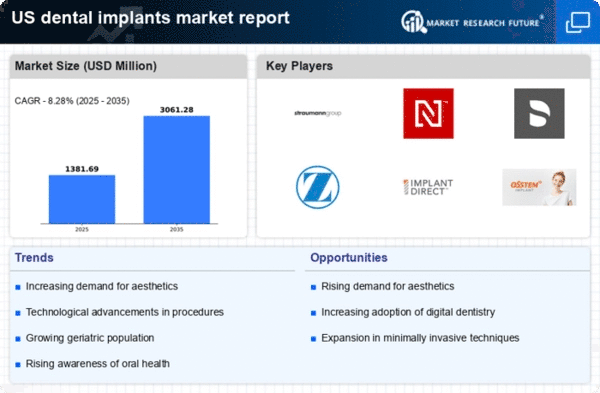

Technological advancements in implantology are transforming the dental implants market. Innovations such as 3D printing, computer-guided surgery, and improved implant materials are enhancing the precision and success rates of dental procedures. For instance, the introduction of titanium implants has significantly improved biocompatibility and longevity, making them a preferred choice among dental professionals. The dental implants market is witnessing a surge in the adoption of these technologies, which not only streamline the surgical process but also reduce recovery times for patients. As a result, the market is expected to expand, with an estimated growth rate of 10% annually over the next five years, driven by these technological enhancements.

Rising Consumer Awareness of Dental Aesthetics

Consumer awareness regarding dental aesthetics is on the rise, significantly influencing the dental implants market. As individuals become more conscious of their appearance, the demand for aesthetically pleasing dental solutions, such as implants, is increasing. This trend is particularly evident among younger demographics who prioritize cosmetic dentistry. The dental implants market is likely to see a surge in demand as more people seek out implants not only for functional purposes but also for enhancing their smiles. This growing focus on aesthetics may lead to a market growth rate of approximately 8% annually, as consumers invest in their dental health and appearance.