Emergence of Edge Computing

The rise of edge computing is reshaping the landscape of the data center-life-cycle-services market. As businesses seek to process data closer to the source, the demand for localized data centers is increasing. This shift is expected to drive investments in life-cycle services that support the deployment and management of edge data centers. By 2025, the edge computing market in the US is anticipated to reach approximately $15 billion, highlighting the need for specialized services that cater to this new paradigm. Companies are looking for life-cycle services that can facilitate the integration of edge computing with existing infrastructure, ensuring seamless operations and data flow. Consequently, the data center-life-cycle-services market is likely to experience growth as organizations adapt to this emerging trend.

Advancements in Data Security

As cyber threats continue to evolve, the demand for robust data security measures is driving the data center-life-cycle-services market. Organizations are increasingly aware of the potential risks associated with data breaches, leading to heightened investments in security solutions. In 2025, the cybersecurity market in the US is projected to exceed $200 billion, reflecting a growing emphasis on protecting sensitive information. Life-cycle services that incorporate security assessments, compliance checks, and incident response planning are becoming integral to data center operations. This trend indicates that the data center-life-cycle-services market must adapt to provide comprehensive security solutions that address the complexities of modern threats, ensuring that data centers remain resilient against potential attacks.

Growing Demand for Cloud Services

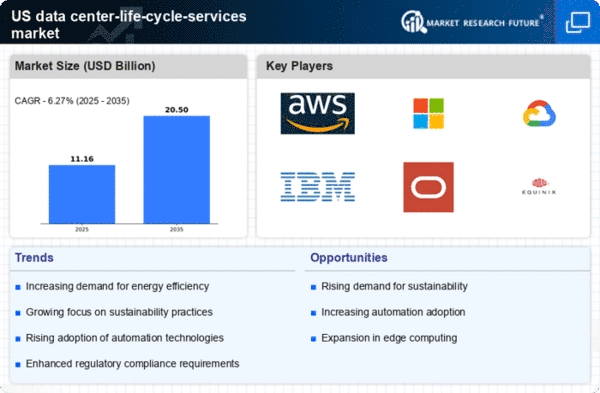

The increasing reliance on cloud computing is a primary driver for the data center-life-cycle-services market. As organizations migrate to cloud-based solutions, the need for efficient data center operations becomes paramount. In 2025, the cloud services market in the US is projected to reach approximately $500 billion, indicating a robust growth trajectory. This surge necessitates enhanced life-cycle services to ensure optimal performance, scalability, and security of data centers. Companies are investing in life-cycle services to manage the complexities associated with cloud integration, including maintenance, upgrades, and energy efficiency. The data center-life-cycle-services market is thus positioned to benefit from this trend, as businesses seek to streamline operations and reduce costs while maintaining high service levels.

Increased Focus on Energy Efficiency

Energy efficiency has emerged as a critical concern for data centers, driving the data center-life-cycle-services market. With energy costs rising and environmental regulations tightening, organizations are compelled to adopt more sustainable practices. In 2025, energy consumption by data centers in the US is expected to account for about 2% of total electricity use, prompting a shift towards energy-efficient technologies. Life-cycle services that focus on optimizing energy use, such as cooling solutions and power management, are becoming essential. This focus not only helps in reducing operational costs but also aligns with corporate sustainability goals. As a result, the data center-life-cycle-services market is likely to see increased demand for services that enhance energy efficiency and reduce carbon footprints.

Regulatory Pressures and Compliance Needs

Regulatory pressures are a significant driver for the data center-life-cycle-services market. As data privacy laws and industry regulations become more stringent, organizations must ensure compliance to avoid hefty fines and reputational damage. In 2025, the compliance market in the US is projected to grow substantially, reflecting the increasing complexity of regulatory requirements. Life-cycle services that assist in navigating these regulations, such as audits, risk assessments, and compliance reporting, are essential for data centers. This trend suggests that the data center-life-cycle-services market will continue to expand as businesses prioritize compliance and seek expert guidance to manage their regulatory obligations effectively.