Expansion of Edge Computing

The rise of edge computing is significantly impacting the data center-life-cycle-services market in Canada. As businesses increasingly require real-time data processing and low-latency applications, the demand for edge data centers is growing. This trend necessitates specialized life-cycle services to support the unique requirements of edge computing environments. By 2025, it is projected that the edge computing market will reach $15 billion in Canada, indicating a substantial opportunity for service providers. Companies are looking for expertise in deploying, managing, and optimizing edge data centers, which in turn drives the demand for comprehensive life-cycle services in the data center-life-cycle-services market.

Growing Demand for Cloud Services

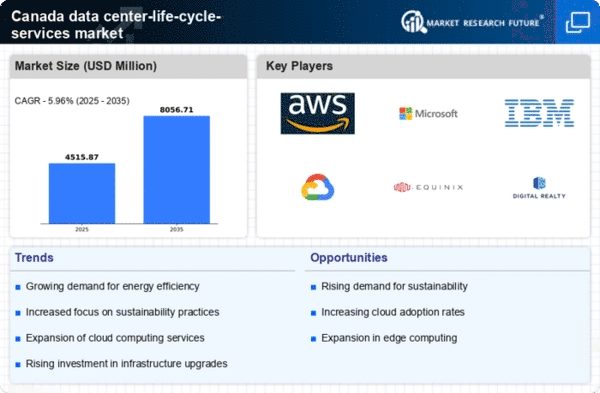

The increasing reliance on cloud computing is a primary driver for the data center-life-cycle-services market. As businesses in Canada transition to cloud-based solutions, the need for efficient data center management becomes paramount. In 2025, it is estimated that cloud services will account for approximately 70% of IT spending in Canada, highlighting the urgency for robust life-cycle services. This shift necessitates comprehensive support throughout the data center's life cycle, from planning and design to maintenance and decommissioning. Companies are seeking to optimize their operations, reduce costs, and enhance performance, which in turn fuels the demand for specialized services in the data center-life-cycle-services market.

Increased Focus on Energy Efficiency

Energy efficiency is becoming a critical concern for data centers in Canada, driving the data center-life-cycle-services market. With rising energy costs and environmental awareness, organizations are seeking ways to reduce their carbon footprint. The Canadian government has set ambitious targets for greenhouse gas emissions reduction, which influences data center operations. As a result, life-cycle services that focus on energy-efficient designs and operations are in high demand. It is estimated that implementing energy-efficient practices can reduce operational costs by up to 20%, making it a financially viable option for many businesses. This emphasis on sustainability is likely to propel the growth of the data center-life-cycle-services market.

Regulatory Compliance and Data Security

In Canada, stringent regulations regarding data protection and privacy are driving the data center-life-cycle-services market. Organizations must comply with laws such as the Personal Information Protection and Electronic Documents Act (PIPEDA), which mandates strict data handling and storage protocols. As a result, data centers are increasingly required to implement life-cycle services that ensure compliance with these regulations. The market is projected to grow as companies invest in services that enhance data security and mitigate risks associated with non-compliance. This focus on regulatory adherence not only protects sensitive information but also fosters trust among clients, thereby propelling the data center-life-cycle-services market.

Technological Advancements in Infrastructure

Technological innovations are reshaping the landscape of the data center-life-cycle-services market. The adoption of advanced technologies such as artificial intelligence (AI), machine learning, and automation is enhancing operational efficiency and reducing costs. In Canada, the market is witnessing a surge in demand for services that integrate these technologies into existing data center operations. By 2025, it is anticipated that AI-driven solutions will improve data center management efficiency by up to 30%. This trend indicates a shift towards more intelligent and responsive data center environments, necessitating specialized life-cycle services to support these advancements.