Evolving Regulatory Landscape

The custom software-development market is increasingly influenced by the evolving regulatory landscape, particularly concerning data protection and privacy. As regulations such as the California Consumer Privacy Act (CCPA) and others gain traction, businesses are compelled to ensure that their custom software solutions comply with these legal requirements. This has led to a growing demand for software that incorporates robust security features and compliance mechanisms. Companies are seeking custom solutions that not only meet regulatory standards but also protect sensitive customer data. The emphasis on compliance is reshaping the development process, as firms prioritize security in their software offerings. This driver is likely to continue impacting the custom software-development market as regulations evolve and businesses adapt to maintain compliance.

Rising Adoption of Cloud Computing

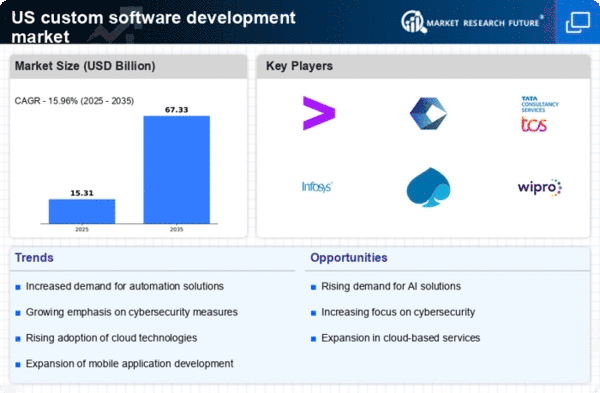

The custom software-development market is experiencing a notable shift towards cloud computing solutions. As organizations increasingly migrate their operations to the cloud, the demand for custom software that integrates seamlessly with cloud platforms is rising. This trend is driven by the need for scalability, flexibility, and cost-effectiveness. According to recent data, approximately 70% of businesses in the US have adopted cloud services, which has created a substantial market for custom software solutions tailored to these environments. Companies are seeking bespoke applications that can leverage cloud capabilities, enhancing operational efficiency and enabling remote access. This shift not only fosters innovation but also necessitates the development of software that can effectively utilize cloud resources, thereby propelling growth in the custom software-development market.

Growing Emphasis on User Experience

In the custom software-development market, there is an increasing focus on user experience (UX) as a critical driver of software design and functionality. Organizations recognize that a positive UX can significantly impact customer satisfaction and retention. As a result, businesses are investing in custom software solutions that prioritize intuitive interfaces and seamless interactions. Research indicates that companies that enhance their UX can see conversion rates increase by up to 400%. This trend compels software developers to adopt user-centered design principles, ensuring that applications are not only functional but also engaging. The emphasis on UX is reshaping the landscape of the custom software-development market, as firms strive to differentiate themselves through superior user experiences.

Increased Focus on Mobile Solutions

The custom software-development market is experiencing a heightened focus on mobile solutions as consumer behavior shifts towards mobile device usage. With over 50% of web traffic in the US now coming from mobile devices, businesses are compelled to develop custom applications that cater to this trend. Organizations are recognizing the importance of mobile accessibility in reaching their target audiences effectively. This shift is driving demand for custom software that is optimized for mobile platforms, ensuring that users have a seamless experience across devices. As mobile technology continues to evolve, the custom software-development market is likely to see sustained growth in this area, with businesses investing in mobile-first strategies to enhance customer engagement.

Demand for Automation and Efficiency

The custom software-development market is witnessing a surge in demand for automation solutions aimed at improving operational efficiency. Businesses are increasingly seeking custom software that automates repetitive tasks, streamlining workflows and reducing human error. This trend is particularly pronounced in sectors such as manufacturing and logistics, where automation can lead to significant cost savings. Data suggests that organizations implementing automation can achieve efficiency gains of up to 30%. As companies look to enhance productivity and reduce operational costs, the need for tailored software solutions that facilitate automation is becoming more pronounced. This driver is likely to continue shaping the custom software-development market as businesses prioritize efficiency and innovation.