Growth of E-commerce Platforms

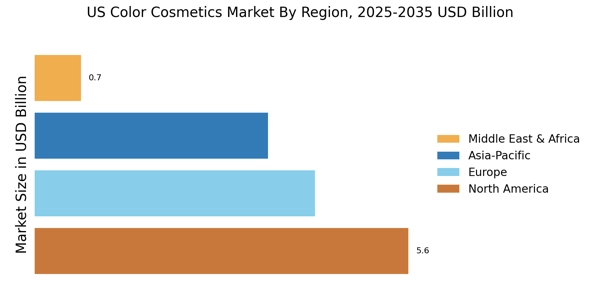

The US Colour Cosmetics Market is experiencing a significant transformation due to the rapid growth of e-commerce platforms. Online sales of cosmetics have surged, with estimates indicating that e-commerce now accounts for over 30% of total cosmetics sales in the US. This shift is largely attributed to the convenience and accessibility that online shopping offers, particularly among younger consumers who prefer to shop digitally. Additionally, the COVID-19 pandemic has accelerated this trend, as more consumers turned to online shopping for their beauty needs. Brands that effectively utilize e-commerce strategies, including social media marketing and influencer partnerships, are likely to thrive in this evolving landscape.

Increased Focus on Personalization

Personalization is becoming a key driver in the US Colour Cosmetics Market, as consumers seek products that cater to their individual needs and preferences. Brands are increasingly offering customizable options, allowing consumers to select shades, formulations, and packaging that resonate with their personal style. This trend is supported by data indicating that personalized products can lead to higher customer satisfaction and loyalty. As consumers become more discerning, companies that prioritize personalization in their product offerings may find themselves at a distinct advantage. The ability to create tailored experiences not only enhances brand loyalty but also encourages repeat purchases, thereby driving overall market growth.

Rising Demand for Natural Ingredients

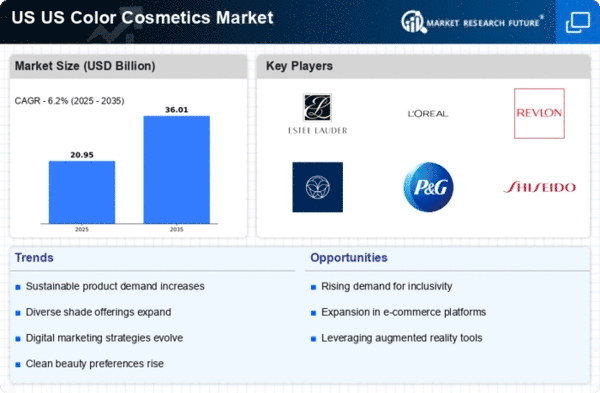

The US Colour Cosmetics Market is witnessing a notable shift towards products formulated with natural ingredients. Consumers are increasingly concerned about the safety and environmental impact of synthetic chemicals, leading to a surge in demand for cosmetics that utilize organic and plant-based components. According to recent data, the market for natural cosmetics in the US is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This trend is not only driven by health-conscious consumers but also by a growing awareness of sustainability. Brands that prioritize natural formulations are likely to capture a larger share of the market, as they align with the values of a significant segment of the population.

Influence of Social Media and Beauty Influencers

The US Colour Cosmetics Market is heavily influenced by social media platforms and beauty influencers. These digital platforms serve as powerful marketing tools, enabling brands to reach a wider audience and engage with consumers in real-time. Influencers, with their ability to create authentic connections with followers, play a crucial role in shaping consumer perceptions and driving purchasing decisions. Data suggests that nearly 70% of consumers are more likely to purchase a product after seeing it endorsed by an influencer. As social media continues to evolve, brands that effectively collaborate with influencers and leverage user-generated content are likely to see increased brand visibility and sales.

Technological Advancements in Product Development

Technological innovations are playing a pivotal role in shaping the US Colour Cosmetics Market. The integration of advanced technologies such as augmented reality (AR) and artificial intelligence (AI) is enhancing the consumer experience by allowing for virtual try-ons and personalized product recommendations. This technological evolution is expected to drive sales, as consumers are more inclined to purchase products that they can visualize on themselves before making a decision. Furthermore, the use of data analytics enables brands to better understand consumer preferences and tailor their offerings accordingly. As a result, companies that leverage these technologies may gain a competitive edge in the increasingly crowded cosmetics market.