Emergence of Smart Manufacturing

The advent of smart manufacturing is reshaping the landscape of the cnc cutting-machines market. With the integration of IoT and data analytics, manufacturers are gaining unprecedented insights into their operations. In 2025, it is projected that smart manufacturing technologies could enhance operational efficiency by up to 25%. Cnc cutting machines equipped with smart capabilities allow for real-time monitoring and predictive maintenance, reducing downtime and optimizing performance. This technological evolution not only improves productivity but also fosters innovation in product design and development. As manufacturers embrace smart solutions, the demand for advanced cnc cutting machines that can seamlessly integrate with these systems is expected to rise, driving market growth.

Increased Focus on Product Quality

In the competitive landscape of manufacturing, the emphasis on product quality is a significant driver for the cnc cutting-machines market. Companies are increasingly recognizing that high-quality products lead to enhanced customer satisfaction and loyalty. In 2025, it is anticipated that 70% of manufacturers will prioritize quality control measures, which directly influences their investment in advanced cutting technologies. Cnc cutting machines offer superior precision and consistency, enabling manufacturers to meet rigorous quality standards. This focus on quality not only enhances brand reputation but also reduces waste and rework costs, ultimately contributing to profitability. As manufacturers strive to differentiate themselves in the market, the demand for high-quality cnc cutting machines is likely to surge.

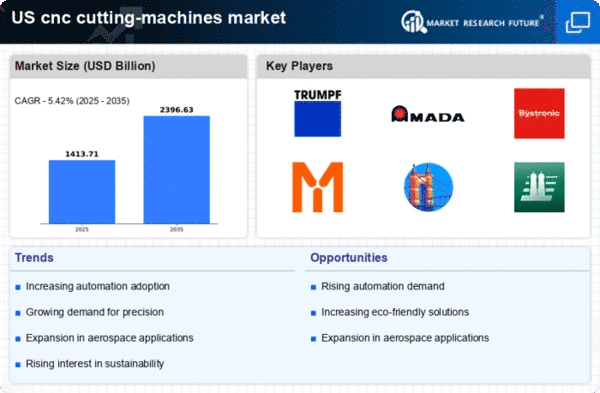

Rising Automation in Manufacturing

The increasing trend towards automation in the manufacturing sector is a pivotal driver for the cnc cutting-machines market. As industries strive for enhanced efficiency and reduced labor costs, the adoption of automated systems becomes paramount. In 2025, it is estimated that automation could lead to a productivity increase of up to 30% in manufacturing processes. This shift not only streamlines operations but also necessitates advanced machinery, such as cnc cutting machines, to maintain precision and quality. Consequently, manufacturers are investing heavily in these technologies, propelling the growth of the cnc cutting-machines market. The integration of robotics and AI into manufacturing processes further emphasizes the need for sophisticated cutting solutions, thereby expanding the market's potential.

Expansion of the Construction Industry

The construction industry is witnessing significant expansion, which serves as a crucial driver for the cnc cutting-machines market. In 2025, the construction sector is projected to reach a value of $1.5 trillion, fueled by infrastructure development and urbanization. This growth necessitates the use of advanced cutting technologies to fabricate materials with precision and efficiency. Cnc cutting machines play a vital role in producing components for various construction applications, including structural elements and decorative features. As the demand for customized and high-quality construction materials increases, manufacturers are likely to invest in cnc cutting technologies to meet these requirements. The expansion of the construction industry thus presents a substantial opportunity for growth within the cnc cutting-machines market.

Growth in Aerospace and Automotive Sectors

The aerospace and automotive industries are experiencing robust growth, which significantly impacts the cnc cutting-machines market. In 2025, the aerospace sector is projected to reach a valuation of $1 trillion, while the automotive industry is expected to surpass $3 trillion. This expansion drives demand for high-precision cutting machines capable of handling complex materials and designs. Cnc cutting machines are essential for producing intricate components that meet stringent safety and performance standards. As these industries evolve, the need for advanced cutting technologies becomes increasingly critical, thereby fostering growth in the cnc cutting-machines market. The emphasis on lightweight materials and fuel efficiency further necessitates the use of cutting-edge machinery to achieve desired specifications.