Innovative Flavor Profiles and Varietals

The canned alcoholic-beverages market is witnessing a trend towards innovative flavor profiles and varietals, appealing to adventurous consumers. As the market evolves, manufacturers are experimenting with unique ingredients and flavor combinations, moving beyond traditional offerings. This innovation not only attracts new consumers but also encourages repeat purchases from existing customers. Data suggests that flavored canned beverages have seen a 40% increase in sales over the past year, indicating a strong consumer appetite for variety. The canned alcoholic-beverages market is thus adapting to these preferences, with brands launching limited-edition flavors and seasonal offerings to maintain consumer interest and drive sales.

Expansion of Retail Distribution Channels

The canned alcoholic-beverages market benefits from the expansion of retail distribution channels, which enhances product accessibility. Retailers are increasingly recognizing the potential of canned alcoholic beverages, leading to their inclusion in a wider array of outlets, from convenience stores to supermarkets. This diversification in distribution not only increases visibility but also caters to varying consumer preferences. Recent statistics indicate that sales through off-premise channels have risen by 30% in the past year, reflecting a shift in consumer purchasing behavior. The canned alcoholic-beverages market is thus likely to see continued growth as more retailers embrace these products, making them readily available to a broader audience.

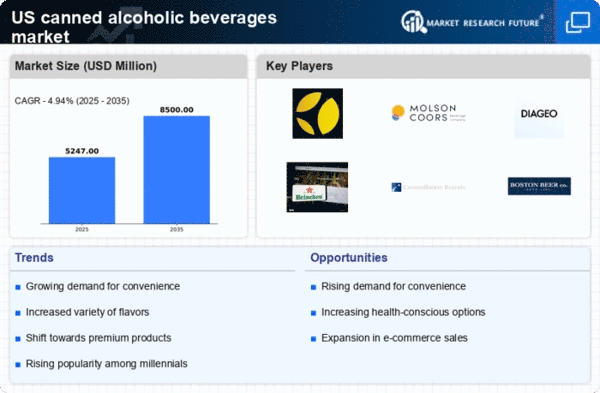

Increased Consumer Demand for Convenience

The canned alcoholic-beverages market experiences a notable surge in consumer demand for convenience. As lifestyles become increasingly fast-paced, consumers seek portable and easy-to-consume options. Canned beverages offer a practical solution, allowing for on-the-go consumption without the need for glassware or extensive preparation. This trend is particularly evident among younger demographics, who prioritize convenience in their purchasing decisions. According to recent data, the market for canned alcoholic beverages has expanded by approximately 25% in the last year alone, indicating a strong preference for these products. The canned alcoholic-beverages market is thus positioned to capitalize on this growing demand, as manufacturers innovate to create more convenient and appealing options for consumers.

Sustainability and Eco-Friendly Packaging

Sustainability has emerged as a critical driver in the canned alcoholic-beverages market, with consumers increasingly favoring eco-friendly packaging solutions. As environmental awareness grows, brands are responding by adopting sustainable practices, such as using recyclable materials and reducing carbon footprints. This shift not only aligns with consumer values but also enhances brand loyalty. Recent surveys indicate that approximately 70% of consumers are willing to pay a premium for products that are environmentally friendly. The canned alcoholic-beverages market is thus likely to see a rise in brands prioritizing sustainability, which could lead to increased market share and consumer engagement.

Social Media Influence and Marketing Strategies

The impact of social media on the canned alcoholic-beverages market cannot be overstated, as brands leverage these platforms for marketing and consumer engagement. Social media campaigns allow for targeted advertising and direct interaction with consumers, fostering brand loyalty and community. Influencer partnerships have also become a popular strategy, with brands collaborating with social media personalities to reach wider audiences. Data indicates that brands utilizing social media marketing have experienced a 50% increase in brand awareness over the past year. The canned alcoholic-beverages market is thus adapting to this digital landscape, recognizing the potential of social media to drive sales and enhance consumer relationships.