Market Trends

Key Emerging Trends in the US C arms Market

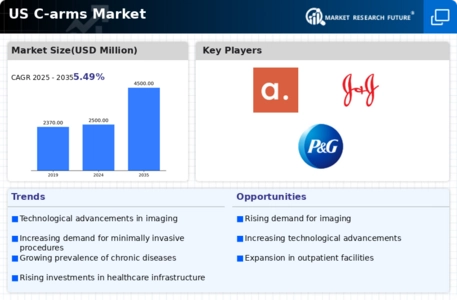

The U.S. C-arm market has witnessed significant trends in recent years, reflecting the dynamic nature of healthcare technology and the evolving needs of medical professionals. One prominent trend is the increasing demand for mobile C-arm systems. These portable imaging devices provide flexibility in positioning during surgical procedures, offering real-time imaging guidance. The portability of C-arms allows medical practitioners to bring advanced imaging capabilities directly to the patient, enhancing the efficiency and accuracy of various medical interventions. One more trend that should be highlighted is the use of innovative technologies in the development and utilization of C-arm systems. The advances in technology have improved on the efficiency of flat-panel detectors, 3 Dimensional imaging ability and other image processing algorithms such as spatial resolution and soft tissue contrast. The integration of these elements empowers healthcare providers to receive high quality images in addition to reducing the patient's exposure to radiation, allying it with the industry's forward motion in terms of safety. The market has exhibited a paradigm shift with the adoption of micro C-arms being many including in onset change in the orthopedic and outpatient settings. These devices have a compact setup and offer extraordinary maneuverability that are tiered for extremity imaging. Along with the increasing popularity of less-invasive techniques of patients, the mini C-arms function as guidance tools that offer real-time imaging for such procedures like orthopedic surgery, pain interventions, and podiatric treatments. Besides the technological advancements, the American C-Arm market faces the vast growth in demand for their refurbished C-arm systems resulted in its acceleration. Medium and large-scale healthcare facilities are forced to find more budget-oriented ways of refreshing old equipment than purchasing modern equipment. C-Arms that have been renovated provide an adequate resolve for the issues of excessive pricing by fetching the same imaging power as new systems at a petty amount. To this end, it is worth mentioning that such an approach is comparable to the industry's pursuit of efficiency, along with the maintenance of high standards of care. The C-arm market growth was yet another factor of the U.S. as outpatient centers and ambulatory surgery centers gained more ground of the market. On the contrary such facilities often rely on imaging components, that are small and versatile and can accommodate varied variety of procedures. The possibility of a C-arm to serve for various medical specialties like cardiology, orthopedics, and general surgery, makes it a valuable instrument for outpatient facilities seeking to offer wide-wall scope services. The U.S. C-arm market is also witnessing a transition towards digitalization and connectivity. Integrated information systems allow for seamless image storage, retrieval, and sharing, facilitating collaboration among healthcare professionals. This interconnected approach enhances the overall efficiency of medical practices and supports the trend towards a more integrated and patient-centric healthcare environment.

Leave a Comment