Surge in Automation Across Industries

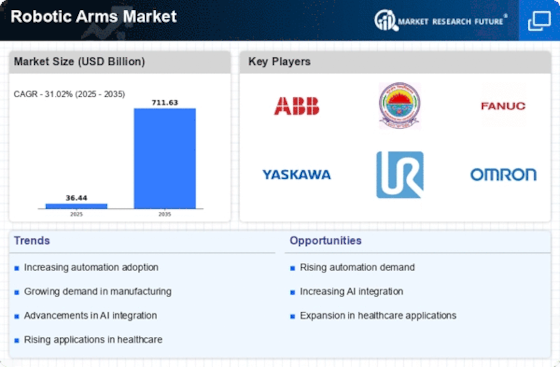

The Robotic Arms Market is experiencing a notable surge in automation across various sectors, including manufacturing, logistics, and agriculture. This trend is driven by the need for increased efficiency and productivity. According to recent data, the automation market is projected to grow at a compound annual growth rate of approximately 10% over the next five years. As industries seek to reduce labor costs and enhance precision, the adoption of robotic arms is becoming more prevalent. Companies are increasingly investing in robotic solutions to streamline operations, which is likely to propel the growth of the Robotic Arms Market. Furthermore, the integration of robotic arms into production lines is expected to lead to significant improvements in output quality and consistency, thereby reinforcing their role in modern industrial practices.

Growing Focus on Safety and Ergonomics

In the Robotic Arms Market, there is a growing focus on safety and ergonomics, particularly in environments where human workers and robots coexist. The implementation of robotic arms is seen as a solution to mitigate workplace injuries and enhance overall safety. Data indicates that workplaces utilizing robotic arms have reported a reduction in accident rates by up to 30%. This trend is particularly evident in sectors such as manufacturing and warehousing, where repetitive tasks can lead to strain injuries. As companies prioritize employee well-being, the demand for robotic arms that can perform hazardous tasks is likely to increase. This shift not only improves safety but also enhances productivity, as human workers can focus on more complex and value-added activities, thereby driving the growth of the Robotic Arms Market.

Technological Advancements in Robotics

Technological advancements are playing a pivotal role in shaping the Robotic Arms Market. Innovations in sensors, artificial intelligence, and machine learning are enhancing the capabilities of robotic arms, making them more versatile and efficient. For instance, the integration of advanced vision systems allows robotic arms to perform complex tasks with greater accuracy. Market data suggests that the adoption of AI-driven robotic arms is expected to increase by over 15% annually in the coming years. These advancements not only improve operational efficiency but also expand the range of applications for robotic arms, from assembly lines to intricate surgical procedures. As technology continues to evolve, the Robotic Arms Market is likely to witness a surge in demand for more sophisticated and intelligent robotic solutions.

Rising Demand in E-commerce and Logistics

The Robotic Arms Market is witnessing a rising demand driven by the expansion of e-commerce and logistics sectors. With the increase in online shopping, companies are seeking efficient solutions to manage inventory and fulfill orders rapidly. Robotic arms are being deployed in warehouses to automate sorting, packing, and shipping processes. Recent statistics indicate that the logistics automation market is expected to grow by approximately 12% annually, significantly contributing to the demand for robotic arms. This trend is further fueled by the need for accuracy and speed in order fulfillment, as consumers increasingly expect quick delivery times. As e-commerce continues to thrive, the Robotic Arms Market is poised for substantial growth, with companies investing in automation technologies to enhance their operational capabilities.

Increased Investment in Research and Development

In the Robotic Arms Market, there is an increased investment in research and development, which is fostering innovation and driving market growth. Companies are allocating significant resources to develop next-generation robotic arms that are more efficient, adaptable, and cost-effective. This trend is evident in the rising number of patents filed in the robotics sector, indicating a robust pipeline of new technologies. Market analysts project that R&D spending in robotics will increase by around 20% over the next few years. This investment is crucial for enhancing the functionality of robotic arms, enabling them to perform a wider array of tasks across different industries. As companies strive to maintain a competitive edge, the focus on R&D is likely to propel advancements in the Robotic Arms Market, leading to the introduction of innovative solutions that meet evolving market demands.