Increased Focus on Biosimilars

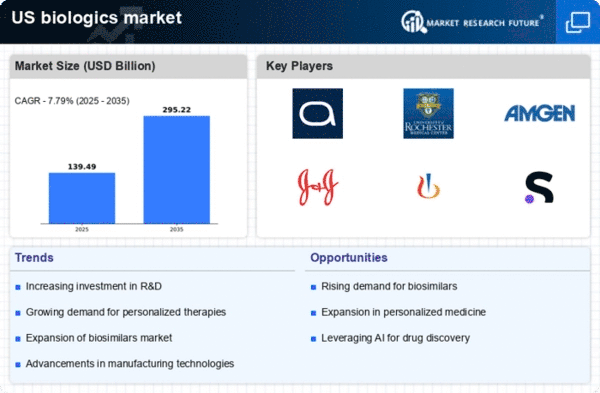

The growing emphasis on biosimilars is reshaping the biologics market. As healthcare costs continue to rise, biosimilars present a cost-effective alternative to expensive biologic therapies. The US market for biosimilars is projected to reach $100 billion by 2027, driven by the need for affordable treatment options. This trend is encouraging pharmaceutical companies to invest in biosimilar development, thereby expanding the range of available therapies. The introduction of biosimilars is likely to enhance competition within the biologics market, ultimately benefiting patients through lower prices and increased access to essential treatments.

Growing Demand for Targeted Therapies

The increasing prevalence of chronic diseases in the US is driving the demand for targeted therapies within the biologics market. As healthcare providers seek more effective treatment options, biologics that specifically target disease mechanisms are gaining traction. This shift is reflected in the market, which is projected to reach approximately $500 billion by 2026. The focus on precision medicine is likely to enhance patient outcomes, thereby further propelling the growth of the biologics market. Additionally, the rise in patient awareness regarding treatment options is contributing to this trend, as individuals seek therapies that align with their specific health needs.

Rising Investment in Biotechnology Startups

The surge in investment in biotechnology startups is a notable driver of the biologics market. Venture capital funding for biotech firms has reached unprecedented levels, with investments exceeding $20 billion in 2025 alone. This influx of capital is enabling startups to innovate and develop new biologics that can address various health challenges. As these companies bring novel therapies to market, the overall landscape of the biologics market is likely to evolve, offering patients more treatment options. The competitive environment fostered by these investments may also lead to accelerated advancements in biologics research and development.

Regulatory Support for Biologics Development

Regulatory agencies in the US are increasingly supportive of biologics development, which is fostering innovation within the biologics market. Initiatives aimed at streamlining the approval process for biologics are encouraging companies to invest in research and development. For instance, the FDA's 21st Century Cures Act has facilitated faster access to new therapies, potentially reducing the time to market by 20-30%. This regulatory environment is likely to stimulate growth in the biologics market, as companies are more inclined to pursue the development of novel biologics that address unmet medical needs.

Advancements in Biomanufacturing Technologies

Innovations in biomanufacturing technologies are significantly impacting the biologics market. The introduction of more efficient production methods, such as continuous manufacturing and single-use technologies, is enhancing the scalability and cost-effectiveness of biologics production. These advancements are expected to reduce production costs by up to 30%, making biologics more accessible to a broader patient population. Furthermore, the ability to produce complex biologics with higher purity levels is likely to improve therapeutic efficacy. As a result, the biologics market is experiencing a transformation that could lead to increased market penetration and a wider array of therapeutic options for patients.