Market Growth Projections

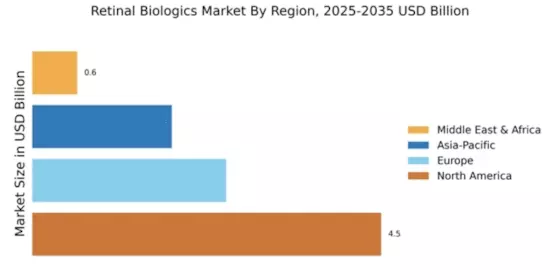

The Global Retinal Biologics Market Industry is projected to experience robust growth, with estimates indicating a rise from 8.38 USD Billion in 2024 to 32.8 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 13.2% from 2025 to 2035, driven by various factors including increasing prevalence of retinal diseases, advancements in biologic therapies, and heightened awareness of eye health. The market dynamics indicate a promising future for stakeholders involved in the development and distribution of retinal biologics.

Regulatory Support and Approvals

Regulatory bodies are playing a pivotal role in shaping the Global Retinal Biologics Market Industry through streamlined approval processes for new therapies. Initiatives aimed at expediting the review of biologics, particularly those addressing serious retinal conditions, encourage innovation and market entry. This supportive regulatory environment fosters competition among manufacturers, leading to a diverse range of treatment options for patients. As a result, the market is expected to experience substantial growth, with a projected increase to 32.8 USD Billion by 2035, reflecting the positive impact of regulatory advancements.

Advancements in Biologic Therapies

Technological advancements in biologic therapies are significantly influencing the Global Retinal Biologics Market Industry. Innovations in drug formulation, delivery systems, and targeted therapies enhance treatment efficacy and patient compliance. For instance, recent developments in gene therapy and monoclonal antibodies have shown promising results in clinical trials, leading to increased adoption. This surge in innovation is likely to contribute to a compound annual growth rate of 13.2% from 2025 to 2035, as healthcare providers seek to incorporate cutting-edge therapies into their treatment protocols.

Rising Prevalence of Retinal Diseases

The increasing incidence of retinal diseases such as age-related macular degeneration and diabetic retinopathy is a primary driver of the Global Retinal Biologics Market Industry. As populations age and lifestyle-related conditions rise, the demand for effective treatment options escalates. In 2024, the market is projected to reach 8.38 USD Billion, reflecting a growing need for innovative biologics. This trend is expected to continue, with the market potentially expanding to 32.8 USD Billion by 2035, indicating a robust growth trajectory fueled by the rising prevalence of these debilitating conditions.

Increasing Awareness and Screening Programs

The rise in awareness regarding retinal diseases and the importance of early detection is propelling the Global Retinal Biologics Market Industry. Public health initiatives and screening programs are being implemented globally to educate populations about the risks associated with retinal conditions. This heightened awareness leads to earlier diagnosis and treatment, subsequently increasing the demand for biologic therapies. As the market evolves, it is anticipated that the increased focus on preventive care will contribute to the projected market growth, reaching 8.38 USD Billion in 2024.

Growing Investment in Research and Development

Investment in research and development within the ophthalmic sector is a crucial driver for the Global Retinal Biologics Market Industry. Pharmaceutical companies and biotech firms are allocating substantial resources to discover novel biologics that address unmet medical needs. This focus on R&D is evidenced by the increasing number of clinical trials and collaborations aimed at developing advanced therapies. As a result, the market is poised for significant growth, with projections indicating a rise to 32.8 USD Billion by 2035, driven by the continuous influx of innovative treatment options.