Consumer Acceptance of Autonomous Vehicles

Consumer acceptance of autonomous vehicles is gradually increasing, which serves as a crucial driver for the autonomous vehicle-ecu market. Surveys indicate that approximately 60% of US consumers are open to using self-driving cars, a figure that has risen steadily over the past few years. This growing acceptance is likely to encourage manufacturers to invest in the development of ECUs that facilitate autonomous driving capabilities. As public perception shifts and more consumers express willingness to embrace this technology, the autonomous vehicle-ecu market may experience accelerated growth, driven by the demand for reliable and safe autonomous systems.

Investment in Autonomous Vehicle Technology

Significant investments in autonomous vehicle technology by both private and public sectors are driving the autonomous vehicle-ecu market. In 2025, venture capital funding for autonomous vehicle startups in the US is estimated to exceed $10 billion, reflecting a strong belief in the potential of self-driving technology. This influx of capital is likely to accelerate research and development efforts, leading to the creation of more sophisticated ECUs that can handle complex driving scenarios. As companies strive to innovate and differentiate their offerings, the autonomous vehicle-ecu market is poised for substantial growth, driven by the need for cutting-edge technology.

Collaboration Between Automakers and Tech Companies

The collaboration between traditional automakers and technology companies is emerging as a significant driver for the market. Partnerships are being formed to leverage expertise in software development, artificial intelligence, and machine learning, which are essential for creating advanced ECUs. In 2025, it is anticipated that over 50% of new vehicle models will incorporate some form of autonomous technology, necessitating the integration of sophisticated ECUs. This trend suggests that the autonomous vehicle-ecu market will benefit from enhanced innovation and faster deployment of autonomous features, as companies combine their strengths to meet market demands.

Rising Demand for Advanced Driver Assistance Systems

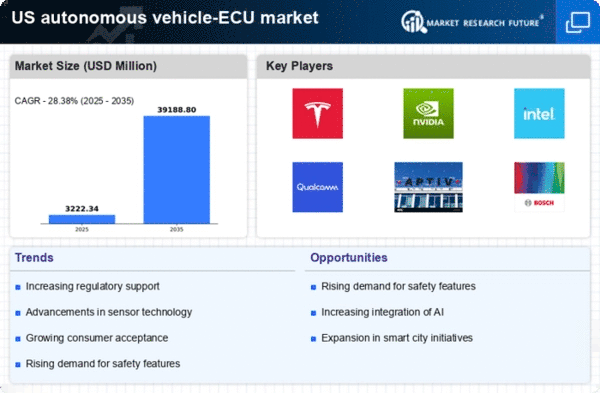

The increasing consumer demand for Advanced Driver Assistance Systems (ADAS) is a pivotal driver for the autonomous vehicle-ecu market. As safety becomes a paramount concern, automakers are integrating sophisticated ECUs to enhance vehicle safety features. In 2025, the market for ADAS is projected to reach approximately $30 billion in the US, indicating a robust growth trajectory. This surge is likely to propel the development of ECUs that support functionalities such as lane-keeping assistance, adaptive cruise control, and automatic emergency braking. Consequently, the autonomous vehicle-ecu market is expected to expand as manufacturers invest in advanced technologies to meet consumer expectations and regulatory requirements.

Government Support for Autonomous Vehicle Initiatives

Government support for autonomous vehicle initiatives is a critical driver influencing the autonomous vehicle-ecu market. Federal and state governments are increasingly investing in infrastructure and regulatory frameworks to facilitate the safe deployment of autonomous vehicles. In 2025, funding for autonomous vehicle research and development is projected to reach $5 billion in the US, highlighting the commitment to advancing this technology. This support is likely to create a favorable environment for the autonomous vehicle-ecu market, as it encourages innovation and provides the necessary resources for manufacturers to develop compliant and efficient ECUs.