Government Policy and Support

Government policies and support play a crucial role in shaping the automotive natural-gas-vehicle market. Various federal and state initiatives are being implemented to promote the use of NGVs, including tax incentives, grants, and funding for infrastructure development. For instance, the U.S. Department of Energy has allocated substantial funds to support natural gas vehicle projects, which has led to a marked increase in public and private investment in this sector. As a result, the automotive natural-gas-vehicle market is poised for growth, as favorable policies encourage both manufacturers and consumers to embrace natural gas as a viable fuel alternative.

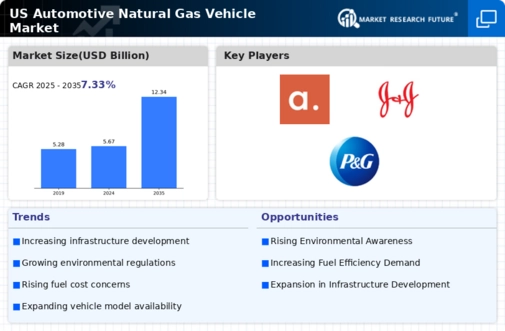

Rising Environmental Awareness

The automotive natural-gas-vehicle market is experiencing a notable shift due to increasing environmental awareness among consumers. As concerns about air quality and climate change intensify, individuals are gravitating towards cleaner fuel alternatives. Natural gas vehicles (NGVs) emit significantly lower levels of harmful pollutants compared to traditional gasoline and diesel vehicles. This shift is reflected in the growing adoption of NGVs, with a reported increase of approximately 15% in sales over the past year. The automotive natural-gas-vehicle market is thus positioned to benefit from this heightened consciousness, as consumers seek sustainable transportation options that align with their values.

Economic Viability of Natural Gas

The economic advantages of natural gas as a vehicle fuel are becoming increasingly apparent, driving growth in the automotive natural-gas-vehicle market. With natural gas prices remaining relatively stable and often lower than gasoline or diesel, consumers and fleet operators are recognizing the cost-saving potential of NGVs. Reports indicate that operating costs for NGVs can be up to 30% lower than their gasoline counterparts. This economic viability is particularly appealing to commercial fleets, which are increasingly adopting NGVs to reduce fuel expenses. Consequently, the automotive natural-gas-vehicle market is likely to see continued expansion as more stakeholders prioritize cost efficiency.

Fleet Adoption and Commercial Use

The automotive natural-gas-vehicle market is witnessing a surge in fleet adoption, particularly among commercial operators. Businesses are increasingly recognizing the benefits of NGVs for their fleets, including lower fuel costs, reduced emissions, and potential tax incentives. Reports indicate that fleet operators can achieve a return on investment within a few years due to the lower operating costs associated with NGVs. This trend is particularly evident in sectors such as public transportation and logistics, where fuel efficiency is paramount. As more companies transition to natural gas vehicles, the automotive natural-gas-vehicle market is expected to expand significantly, driven by the demand for sustainable and cost-effective transportation solutions.

Technological Innovations in NGVs

Technological advancements in the automotive natural-gas-vehicle market are enhancing the performance and appeal of NGVs. Innovations in engine design, fuel storage, and emissions control systems are making NGVs more efficient and user-friendly. For example, advancements in composite materials for fuel tanks have improved safety and reduced weight, thereby increasing vehicle range. Additionally, the integration of smart technologies is enabling better monitoring of fuel consumption and emissions. These innovations are likely to attract a broader consumer base, as the automotive natural-gas-vehicle market evolves to meet the demands of modern drivers seeking both performance and sustainability.