Consumer Demand for Cleaner Vehicles

Consumer demand for cleaner vehicles is significantly influencing the automotive exhaust-emission-control-device market. As awareness of environmental issues grows, consumers are increasingly seeking vehicles that produce lower emissions. This shift in consumer preference is prompting manufacturers to prioritize the development of vehicles equipped with advanced emission control technologies. In 2025, it is anticipated that nearly 30% of new vehicle sales will be hybrid or electric, further driving the need for effective exhaust-emission-control devices. This trend suggests that the automotive exhaust-emission-control-device market will continue to expand as manufacturers respond to consumer expectations for sustainability and environmental responsibility.

Rising Fuel Prices and Economic Factors

Rising fuel prices and broader economic factors are contributing to the growth of the automotive exhaust-emission-control-device market. As fuel costs increase, consumers are more inclined to seek vehicles that offer better fuel efficiency and lower emissions. This trend is prompting manufacturers to invest in advanced emission control technologies that enhance fuel economy. In 2025, it is projected that the automotive exhaust-emission-control-device market could see a growth rate of around 4% as economic pressures drive consumers towards more efficient vehicles. This dynamic indicates that the automotive exhaust-emission-control-device market is likely to benefit from the interplay between economic conditions and consumer preferences.

Government Incentives for Emission Reduction

Government incentives aimed at emission reduction are significantly impacting the automotive exhaust-emission-control-device market. Various federal and state programs offer financial incentives for manufacturers and consumers to adopt cleaner technologies. These incentives can include tax credits, rebates, and grants for the development and purchase of vehicles with advanced emission control systems. As of 2025, it is estimated that these programs could lead to a market growth of approximately 5% annually, as they encourage the adoption of technologies that reduce emissions. This supportive regulatory environment is likely to bolster the automotive exhaust-emission-control-device market, fostering innovation and investment in cleaner technologies.

Increasing Stringency of Emission Regulations

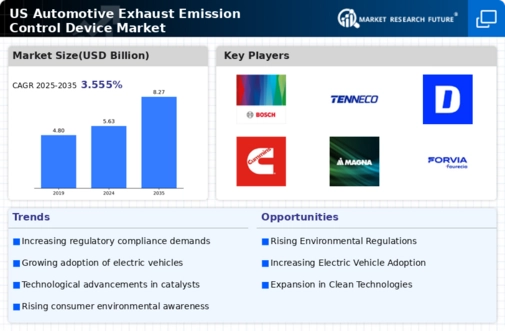

The automotive exhaust-emission-control-device market is experiencing a notable surge due to the increasing stringency of emission regulations in the US. Regulatory bodies, such as the Environmental Protection Agency (EPA), have implemented more rigorous standards aimed at reducing harmful emissions from vehicles. This has led manufacturers to invest heavily in advanced emission control technologies, which are essential for compliance. As of 2025, it is estimated that the market for these devices could reach approximately $10 billion, driven by the need for compliance with regulations that mandate reductions in nitrogen oxides (NOx) and particulate matter (PM). Consequently, The automotive exhaust-emission-control-device market is set for growth as manufacturers adapt to these evolving regulatory landscapes.

Technological Advancements in Emission Control

Technological advancements play a pivotal role in shaping the automotive exhaust-emission-control-device market. Innovations such as selective catalytic reduction (SCR) systems and advanced particulate filters are becoming increasingly prevalent. These technologies not only enhance the efficiency of emission control but also improve vehicle performance. The integration of real-time monitoring systems allows for better management of emissions, which is crucial for meeting regulatory standards. As of 2025, the market is projected to grow at a CAGR of around 6%, reflecting the industry's commitment to adopting cutting-edge technologies. This trend indicates a robust future for the automotive exhaust-emission-control-device market as manufacturers strive to enhance their product offerings.