Rising Security Concerns

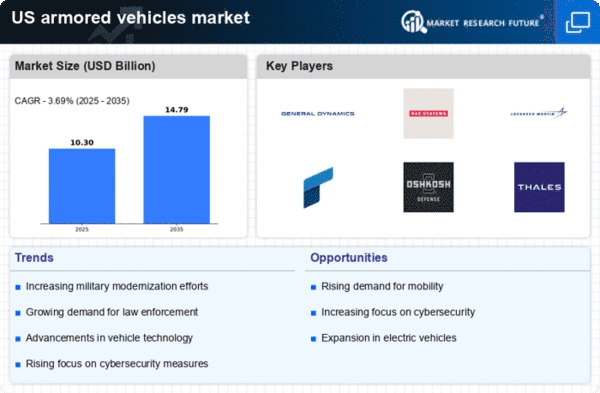

The armored vehicles market is experiencing growth driven by escalating security concerns across various sectors in the US. With increasing threats from terrorism, civil unrest, and organized crime, both governmental and private entities are investing in armored vehicles to ensure safety and protection. The demand for armored personnel carriers and tactical vehicles has surged, as organizations seek to enhance their operational capabilities. In 2025, the market is projected to reach approximately $XX billion, reflecting a compound annual growth rate (CAGR) of XX% over the next five years. This trend indicates a robust commitment to security measures, thereby bolstering the armored vehicles market.

Technological Integration

The integration of advanced technologies into armored vehicles is a pivotal driver for the armored vehicles market. Innovations such as artificial intelligence, enhanced communication systems, and improved armor materials are transforming the capabilities of these vehicles. The incorporation of smart technologies not only enhances operational efficiency but also increases the survivability of personnel in combat situations. As the US military and law enforcement agencies prioritize modernization, the armored vehicles market is likely to witness a significant uptick in demand for vehicles equipped with cutting-edge technology. This trend is expected to contribute to a market valuation of around $XX billion by 2025.

Government Contracts and Procurement

Government contracts play a crucial role in shaping the armored vehicles market. The US government allocates substantial budgets for defense procurement, which includes the acquisition of armored vehicles for military and law enforcement purposes. In recent years, the Department of Defense has increased its spending on armored vehicles, with contracts often exceeding $XX billion annually. This consistent flow of government funding not only stabilizes the market but also encourages manufacturers to innovate and improve their offerings. As a result, the armored vehicles market is poised for sustained growth, driven by ongoing government initiatives and procurement strategies.

International Military Collaborations

International military collaborations are emerging as a significant driver for the armored vehicles market. The US engages in various defense partnerships and joint exercises with allied nations, necessitating the procurement of compatible armored vehicles. These collaborations often lead to shared technology and resources, enhancing the capabilities of the armored vehicles market. As the US continues to strengthen its defense ties globally, the demand for interoperable armored vehicles is likely to rise, contributing to a projected market growth of approximately $XX billion by 2025.

Urbanization and Law Enforcement Needs

The trend of urbanization in the US is influencing the armored vehicles market, particularly in the context of law enforcement. As cities grow and populations increase, the demand for effective policing solutions rises. Law enforcement agencies are increasingly adopting armored vehicles to address challenges such as riots, protests, and high-risk operations. The armored vehicles market is responding to this need by providing specialized vehicles designed for urban environments. This shift is expected to drive market growth, with projections indicating a potential increase in market size by XX% over the next few years.