Emergence of Edge Computing and IoT Applications

The all flash-array market is being transformed by the emergence of edge computing and Internet of Things (IoT) applications. As more devices become interconnected, the volume of data generated at the edge is increasing exponentially. This necessitates storage solutions that can handle high-speed data processing and low-latency access. All flash arrays are well-suited for these environments, providing the performance required to support real-time analytics and decision-making. Market projections indicate that the all flash-array market could see a growth rate of 25% in the next few years, driven by the proliferation of IoT devices and the need for efficient data management at the edge. This trend underscores the adaptability of the all flash-array market in meeting the demands of a rapidly evolving technological landscape.

Growing Importance of Disaster Recovery Solutions

The all flash-array market is increasingly shaped by the growing importance of disaster recovery solutions. As organizations face rising threats from cyberattacks and natural disasters, the need for reliable data protection strategies has become paramount. All flash arrays offer enhanced data redundancy and faster recovery times, making them an attractive option for businesses looking to safeguard their critical data. Recent surveys indicate that nearly 60% of organizations prioritize disaster recovery in their IT budgets, further driving the demand for all flash-array solutions. This trend suggests that the all flash-array market will continue to evolve, as companies seek to implement robust disaster recovery plans that ensure business continuity in the face of unforeseen challenges.

Rising Demand for High-Performance Storage Solutions

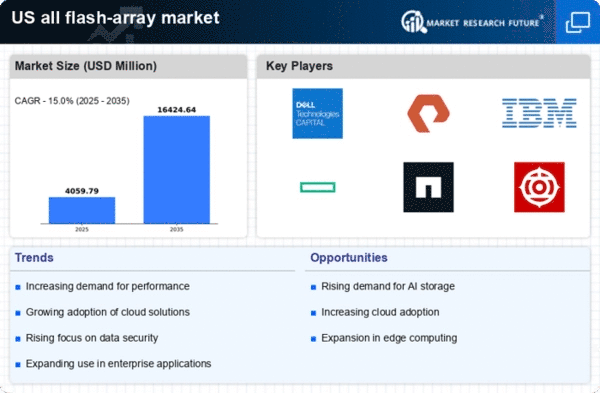

The all flash-array market experiences a notable surge in demand for high-performance storage solutions. Organizations are increasingly reliant on data-intensive applications, which necessitate rapid data access and processing capabilities. This trend is particularly evident in sectors such as finance and healthcare, where performance can directly impact operational efficiency. According to recent data, the all flash-array market is projected to grow at a CAGR of approximately 20% over the next five years, driven by the need for faster data retrieval and lower latency. As businesses continue to prioritize performance, the all flash-array market is likely to see a significant uptick in adoption rates, as companies seek to enhance their IT infrastructure to support advanced analytics and real-time data processing.

Shift Towards Virtualization and Software-Defined Storage

The all flash-array market is witnessing a shift towards virtualization and software-defined storage solutions. This transition allows organizations to optimize their storage resources and improve scalability. Virtualization technologies enable the consolidation of storage systems, which can lead to reduced costs and improved management efficiency. As businesses increasingly adopt hybrid cloud environments, the demand for software-defined storage solutions that integrate seamlessly with existing infrastructure is expected to rise. Recent statistics indicate that the all flash-array market is anticipated to reach a valuation of $10 billion by 2026, reflecting the growing preference for flexible and agile storage solutions. This trend underscores the importance of adaptability in the all flash-array market, as organizations seek to align their storage strategies with evolving business needs.

Increased Focus on Data Analytics and Business Intelligence

The all flash-array market is significantly influenced by the increasing focus on data analytics and business intelligence. Organizations are recognizing the value of data-driven decision-making, which necessitates robust storage solutions capable of handling large volumes of data. The ability to analyze data in real-time is becoming a competitive advantage, prompting businesses to invest in high-performance storage systems. Recent market analysis suggests that the all flash-array market could account for over 30% of the total enterprise storage market by 2025, driven by the need for efficient data processing and analytics capabilities. This trend highlights the critical role of the all flash-array market in enabling organizations to leverage their data assets effectively.