Growing Awareness of Aesthetic Treatments

There is a marked increase in awareness regarding aesthetic treatments among the US population, contributing to the expansion of the aesthetic lasers market. Educational campaigns and social media platforms have played a pivotal role in disseminating information about the benefits and availability of laser treatments. As consumers become more informed about the options available for skin care and rejuvenation, the demand for aesthetic laser procedures is expected to rise. Market data indicates that the aesthetic lasers market has seen a growth rate of approximately 10% annually, reflecting this heightened awareness. This trend suggests that as more individuals recognize the potential of aesthetic lasers, the market will likely continue to flourish, driven by informed consumer choices.

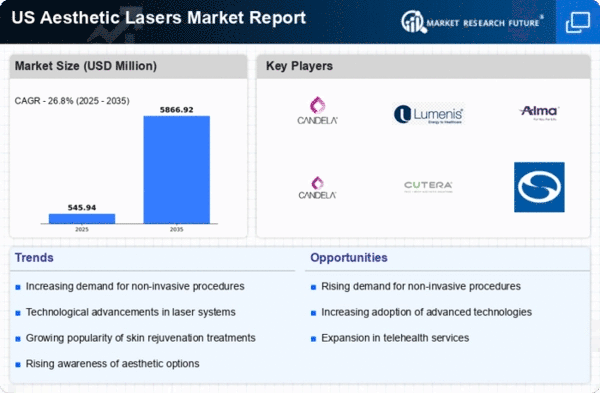

Rising Demand for Non-Invasive Procedures

The aesthetic lasers market is experiencing a surge in demand for non-invasive cosmetic procedures. This trend is driven by an increasing consumer preference for treatments that offer minimal downtime and reduced recovery periods. According to recent data, non-invasive procedures account for approximately 70% of the total cosmetic procedures performed in the US. As individuals seek effective solutions for skin rejuvenation, hair removal, and other aesthetic concerns, The aesthetic lasers market is expected to grow. The appeal of non-invasive options is further enhanced by advancements in laser technology, which provide enhanced efficacy and safety. This shift towards non-invasive treatments is likely to continue, propelling the aesthetic lasers market forward as more consumers opt for these innovative solutions.

Increasing Investment in Aesthetic Clinics

The aesthetic lasers market is experiencing increased investment in aesthetic clinics across the US. As the demand for aesthetic procedures grows, more entrepreneurs and established medical professionals are entering the market, leading to the establishment of new clinics. This influx of investment is not only expanding the availability of aesthetic laser treatments but also enhancing competition among providers. Market analysis suggests that the number of aesthetic clinics has increased by approximately 15% over the past few years, indicating a robust growth trajectory. This trend is likely to continue, as both consumers and investors recognize the lucrative potential of the aesthetic lasers market, further driving its expansion.

Technological Innovations in Laser Systems

Technological innovations are significantly shaping the aesthetic lasers market, with new laser systems being developed to enhance treatment outcomes. The introduction of advanced laser technologies, such as fractional lasers and picosecond lasers, has revolutionized the way aesthetic procedures are performed. These innovations not only improve the effectiveness of treatments but also reduce side effects and recovery times. For instance, picosecond lasers have been shown to provide superior results in tattoo removal and skin resurfacing. As these technologies become more accessible, practitioners are increasingly adopting them, thereby driving growth in the aesthetic lasers market. The continuous evolution of laser technology indicates a promising future for the industry, as it adapts to meet the changing needs of consumers.

Shifting Demographics and Consumer Preferences

The demographic landscape of consumers seeking aesthetic treatments is evolving, which is influencing the aesthetic lasers market. Younger generations, particularly millennials and Gen Z, are increasingly prioritizing appearance and self-care, leading to a rise in demand for aesthetic procedures. This shift in consumer preferences is reflected in market data, which shows that individuals aged 18-34 represent a growing segment of the clientele for aesthetic laser treatments. As these demographics become more engaged with aesthetic options, the market is likely to adapt to their preferences, offering tailored solutions that resonate with their values. This demographic shift suggests a promising future for the aesthetic lasers market, as it aligns with the desires of a younger, more appearance-conscious population.