Rising Aesthetic Consciousness

The aesthetic lasers market in the UK is experiencing a notable surge in demand, driven by an increasing societal focus on personal appearance. This trend is particularly evident among younger demographics, who are more inclined to seek cosmetic enhancements. According to recent surveys, approximately 40% of individuals aged 18-34 express interest in aesthetic procedures, indicating a shift in cultural norms towards acceptance of such treatments. This growing aesthetic consciousness is likely to propel the market forward, as more individuals seek non-invasive solutions for skin rejuvenation and body contouring. The aesthetic lasers market is thus positioned to benefit from this evolving mindset, as clinics and practitioners adapt their offerings to meet the rising expectations of consumers.

Expansion of Medical Aesthetics

The aesthetic lasers market is benefiting from the broader expansion of the medical aesthetics field, which encompasses a range of non-surgical procedures. As more healthcare professionals enter this sector, the availability of aesthetic laser treatments is increasing. This trend is supported by a growing number of training programs and certifications for practitioners, enhancing the quality of services offered. The market is projected to reach £1 billion by 2027, reflecting the increasing acceptance of aesthetic procedures as part of routine healthcare. The aesthetic lasers market is thus poised for growth, as it aligns with the evolving landscape of medical aesthetics and consumer preferences.

Innovations in Laser Technology

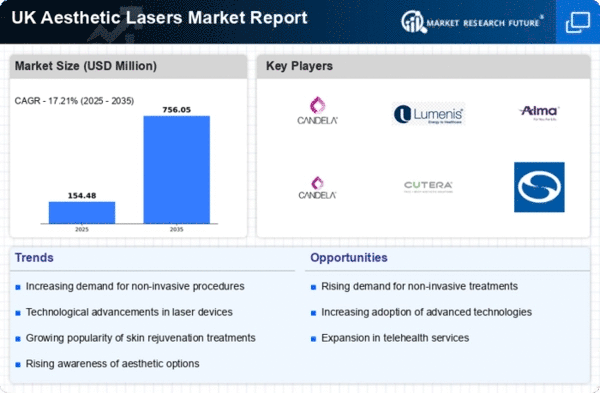

Technological advancements in laser systems are significantly influencing the aesthetic lasers market. Innovations such as fractional laser technology and picosecond lasers have enhanced treatment efficacy and safety, attracting a broader clientele. For instance, the introduction of non-ablative lasers has reduced recovery times, making procedures more appealing to busy individuals. The market is projected to grow at a CAGR of 12% over the next five years, largely due to these technological improvements. As practitioners adopt the latest laser technologies, the aesthetic lasers market is likely to see an influx of new treatments, further stimulating consumer interest and investment in aesthetic procedures.

Growing Influence of Social Media

The aesthetic lasers market is increasingly shaped by the influence of social media platforms, where beauty standards and trends are rapidly disseminated. Influencers and celebrities often showcase their aesthetic procedures, creating a ripple effect that encourages followers to pursue similar treatments. This phenomenon has led to a rise in inquiries and bookings for laser treatments, particularly among younger consumers. Data suggests that clinics reporting active social media engagement have seen a 30% increase in client consultations. As the aesthetic lasers market continues to leverage social media for marketing, it is likely to attract a new generation of clients eager to enhance their appearance.

Increased Accessibility of Treatments

The aesthetic lasers market is witnessing a trend towards greater accessibility of treatments, which is likely to drive growth. With the proliferation of aesthetic clinics across urban and suburban areas, more individuals can access laser treatments without significant travel. Additionally, competitive pricing strategies have emerged, making procedures more affordable. Reports indicate that the average cost of laser treatments has decreased by approximately 15% over the past three years, making them more attainable for a wider audience. This increased accessibility is expected to expand the customer base for the aesthetic lasers market, as more people consider these treatments as viable options for enhancing their appearance.