Supportive Regulatory Environment

A supportive regulatory environment is playing a crucial role in shaping the acute agitation-aggression-treatment market. Recent policy changes and funding initiatives aimed at improving mental health services are facilitating access to treatment options. The US government has been actively promoting mental health awareness and funding research into effective therapies. This regulatory support is likely to encourage pharmaceutical companies and healthcare providers to invest in the development of new treatments for acute agitation and aggression. As a result, the market may experience accelerated growth, driven by the alignment of public health goals with industry innovation.

Increased Focus on Patient-Centered Care

The shift towards patient-centered care is influencing the acute agitation-aggression-treatment market. Healthcare providers are increasingly recognizing the importance of tailoring treatments to individual patient needs, which enhances engagement and compliance. This approach not only improves patient outcomes but also fosters a more supportive environment for those experiencing acute agitation and aggression. As a result, healthcare systems are likely to allocate more resources towards developing personalized treatment plans, thereby driving growth in the market. The emphasis on holistic care models may lead to the integration of various therapeutic modalities, further enriching the acute agitation-aggression-treatment market.

Advancements in Pharmacological Treatments

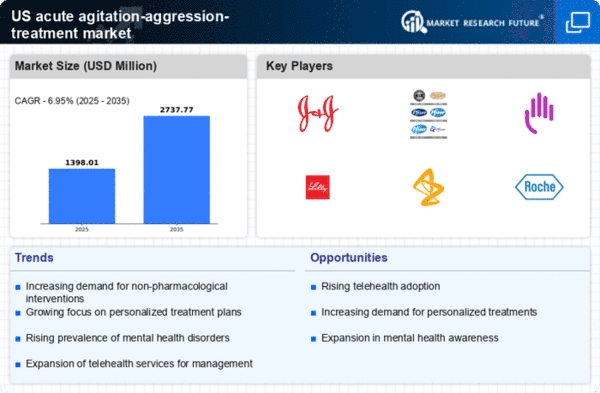

Recent advancements in pharmacological treatments are significantly impacting the acute agitation-aggression-treatment market. New drug formulations and delivery methods are being developed to enhance efficacy and reduce side effects. For instance, the introduction of rapid-acting medications has shown promise in managing acute episodes effectively. The market is projected to grow as these innovations become more widely adopted, with estimates suggesting a compound annual growth rate (CAGR) of around 7% over the next five years. This growth is indicative of the ongoing research and development efforts aimed at improving treatment outcomes for patients experiencing acute agitation and aggression.

Rising Awareness and Education Initiatives

Rising awareness and education initiatives regarding mental health are contributing to the growth of the acute agitation-aggression-treatment market. Campaigns aimed at destigmatizing mental health issues are encouraging individuals to seek help sooner, which may lead to increased demand for treatment options. Educational programs targeting healthcare professionals are also enhancing the understanding of effective management strategies for acute agitation and aggression. This heightened awareness is likely to result in a more proactive approach to treatment, thereby expanding the market. As more individuals become informed about available resources, the acute agitation-aggression-treatment market is expected to see a corresponding increase in utilization.

Increasing Prevalence of Mental Health Disorders

The acute agitation-aggression-treatment market is experiencing growth due to the rising prevalence of mental health disorders in the US. According to the National Institute of Mental Health, approximately 20.6% of adults in the US experience mental illness annually. This increasing incidence necessitates effective treatment options for acute agitation and aggression, driving demand for innovative therapies. As healthcare providers seek to address these challenges, the market is likely to expand, with a focus on developing targeted interventions. The growing awareness of mental health issues among the public and healthcare professionals further supports this trend, indicating a potential for increased investment in the acute agitation-aggression-treatment market.