Advancements in Surgical Techniques

The acoustic neuroma market is significantly influenced by advancements in surgical techniques. Innovations such as minimally invasive procedures and enhanced imaging technologies have improved surgical outcomes and reduced recovery times for patients. Techniques like the retrosigmoid approach and endoscopic surgery are gaining traction, leading to better patient satisfaction and lower complication rates. As a result, healthcare providers are increasingly adopting these methods, which may drive the growth of the acoustic neuroma market. The financial implications are notable, with surgical costs averaging around $50,000 per procedure, indicating a substantial market potential for both surgical instruments and postoperative care.

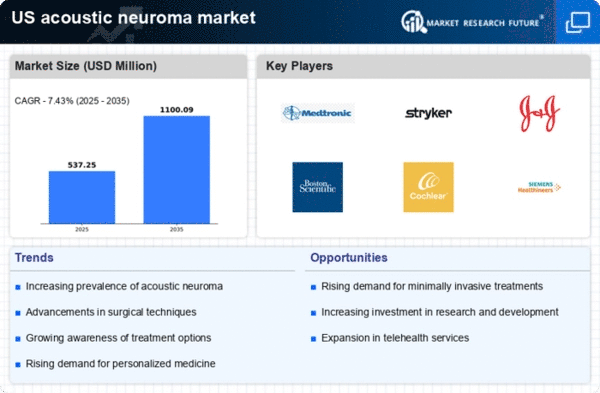

Rising Incidence of Acoustic Neuroma Cases

The acoustic neuroma market is experiencing growth due to the increasing incidence of acoustic neuroma cases in the US. Recent data indicates that approximately 3,000 new cases are diagnosed annually, leading to heightened demand for effective treatment options. This rise in cases is attributed to factors such as improved diagnostic techniques and increased awareness among healthcare providers. As more patients seek medical attention for symptoms like hearing loss and tinnitus, the acoustic neuroma market is likely to expand. Furthermore, the growing population and aging demographic contribute to the prevalence of this condition, suggesting a sustained need for innovative therapies and surgical interventions in the coming years.

Growing Investment in Research and Development

Investment in research and development (R&D) is a crucial driver for the acoustic neuroma market. Pharmaceutical companies and medical device manufacturers are allocating significant resources to develop novel therapies and diagnostic tools. This focus on R&D is expected to yield innovative treatment options, such as targeted therapies and advanced imaging techniques, which could enhance patient outcomes. The US government has also been supportive, providing funding for research initiatives aimed at understanding the biology of acoustic neuromas. As R&D efforts continue to progress, the acoustic neuroma market may witness an influx of new products and technologies, potentially reshaping treatment paradigms.

Rising Demand for Non-Invasive Treatment Options

The acoustic neuroma market is witnessing a rising demand for non-invasive treatment options. Patients are increasingly seeking alternatives to traditional surgical interventions due to concerns about risks and recovery times. Non-invasive therapies, such as stereotactic radiosurgery, are gaining popularity as effective options for managing acoustic neuromas. This shift in patient preference is prompting healthcare providers to explore and offer these alternatives, thereby influencing the acoustic neuroma market. The market for non-invasive treatments is projected to grow, with estimates suggesting a potential increase in market share by 20% over the next five years, reflecting changing patient attitudes towards treatment.

Increased Collaboration Among Healthcare Providers

Collaboration among healthcare providers is emerging as a vital driver in the acoustic neuroma market. Multidisciplinary teams, including otolaryngologists, neurosurgeons, and audiologists, are working together to provide comprehensive care for patients. This collaborative approach not only improves patient outcomes but also enhances the overall treatment experience. As healthcare systems recognize the benefits of integrated care, the acoustic neuroma market is likely to see an increase in referrals and shared resources. This trend may lead to more efficient treatment pathways and a greater emphasis on patient-centered care, ultimately benefiting both patients and healthcare providers.