Rising Demand for Smart Devices

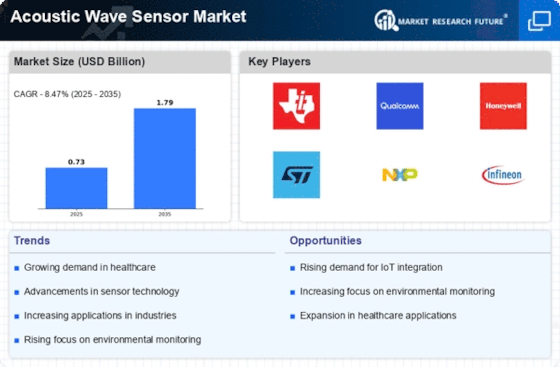

The Acoustic Wave Sensor Market is experiencing a notable surge in demand for smart devices, which are increasingly integrated into various applications. This trend is driven by the growing consumer preference for automation and connectivity in everyday products. As smart homes and smart cities gain traction, the need for advanced sensors that can provide real-time data becomes paramount. Acoustic wave sensors, known for their precision and reliability, are being utilized in smart appliances, wearables, and industrial automation. The market for smart devices is projected to reach substantial figures, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This growth is likely to propel the Acoustic Wave Sensor Market, as manufacturers seek to incorporate these sensors into their innovative solutions.

Advancements in Industrial Automation

The Acoustic Wave Sensor Market is poised for growth due to advancements in industrial automation. As industries strive for increased efficiency and reduced operational costs, the adoption of smart manufacturing technologies is on the rise. Acoustic wave sensors play a crucial role in this transformation by enabling precise measurements and monitoring of various parameters in manufacturing processes. Their ability to function in harsh environments makes them suitable for diverse industrial applications, including pressure and temperature monitoring. The industrial automation market is projected to grow significantly, with estimates suggesting a compound annual growth rate of around 10%. This growth is likely to drive demand for acoustic wave sensors, as industries seek reliable solutions to enhance productivity and operational efficiency.

Increasing Focus on Healthcare Applications

The Acoustic Wave Sensor Market is significantly influenced by the increasing focus on healthcare applications. These sensors are being employed in various medical devices for monitoring and diagnostics, owing to their high sensitivity and accuracy. The healthcare sector is witnessing a shift towards non-invasive and real-time monitoring solutions, which aligns with the capabilities of acoustic wave sensors. For instance, these sensors are utilized in blood glucose monitoring systems and respiratory devices, enhancing patient care and management. The healthcare market is expected to expand, with projections indicating a growth rate of approximately 15% annually. This trend suggests a robust opportunity for the Acoustic Wave Sensor Market to cater to the evolving needs of healthcare providers and patients alike.

Growing Environmental Monitoring Initiatives

The Acoustic Wave Sensor Market is benefiting from the growing emphasis on environmental monitoring initiatives. Governments and organizations are increasingly investing in technologies that can provide accurate data on air and water quality, as well as other environmental parameters. Acoustic wave sensors are particularly well-suited for these applications due to their sensitivity and ability to detect a wide range of substances. The environmental monitoring market is expected to expand, with forecasts indicating a growth rate of approximately 12% annually. This trend suggests a promising avenue for the Acoustic Wave Sensor Market, as these sensors can be integrated into various monitoring systems to ensure compliance with environmental regulations and promote sustainability.

Emerging Applications in Consumer Electronics

The Acoustic Wave Sensor Market is witnessing emerging applications in consumer electronics, driven by the increasing demand for innovative features in electronic devices. Acoustic wave sensors are being integrated into smartphones, tablets, and other consumer gadgets to enhance user experience through functionalities such as touch sensing and voice recognition. The consumer electronics market is projected to grow at a compound annual growth rate of around 8%, indicating a robust demand for advanced sensor technologies. This growth presents a significant opportunity for the Acoustic Wave Sensor Market, as manufacturers seek to differentiate their products by incorporating cutting-edge sensor solutions that offer improved performance and functionality.