Rising Demand for High-Speed Internet

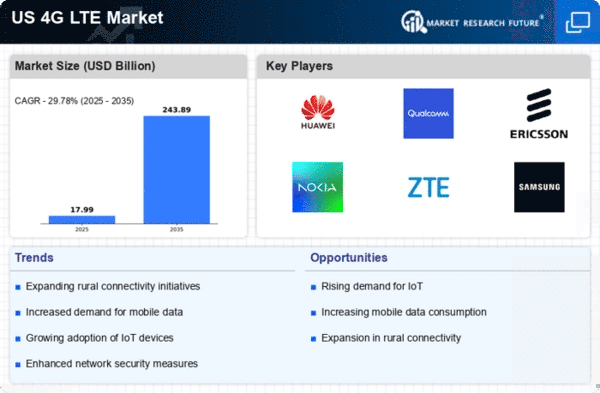

The 4g lte market is experiencing a notable surge in demand for high-speed internet services. As consumers increasingly rely on mobile devices for various applications, including streaming, gaming, and remote work, the need for faster data transmission becomes paramount. Recent data indicates that mobile data traffic in the US is projected to grow at a CAGR of approximately 30% through 2025. This trend is likely to drive investments in 4g lte infrastructure, as service providers strive to meet consumer expectations for seamless connectivity. Furthermore, the proliferation of smart devices and IoT applications is expected to further fuel this demand, compelling telecom operators to enhance their 4g lte offerings to remain competitive in the market.

Increased Adoption of Mobile Applications

The increased adoption of mobile applications is a driving force behind the growth of the 4g lte market. As more consumers turn to mobile apps for everyday tasks, such as banking, shopping, and social networking, the demand for reliable and fast mobile internet services intensifies. This trend is particularly evident among younger demographics, who are more inclined to use mobile platforms for various activities. Data suggests that mobile app downloads in the US have surpassed 200 billion, indicating a robust market for mobile services. Consequently, telecom providers are likely to enhance their 4g lte capabilities to accommodate this growing user base, ensuring that they can deliver the necessary speed and reliability.

Government Initiatives for Digital Inclusion

Government initiatives aimed at promoting digital inclusion are significantly influencing the 4g lte market. Various federal and state programs are designed to expand broadband access, particularly in underserved areas. These initiatives often involve funding for infrastructure development and incentives for telecom providers to extend their services to rural and low-income communities. For instance, the Federal Communications Commission (FCC) has allocated substantial resources to support broadband expansion projects. As a result, the 4g lte market is likely to benefit from increased investment and infrastructure development, ultimately leading to greater connectivity and access for a broader segment of the population.

Competitive Landscape Among Telecom Operators

The competitive landscape among telecom operators is a significant driver of the 4g lte market. With multiple players vying for market share, companies are compelled to innovate and improve their service offerings. This competition often leads to aggressive pricing strategies, promotional offers, and enhanced customer service, all of which benefit consumers. Recent reports indicate that the top four telecom providers in the US have invested over $50 billion collectively in network expansion and upgrades in the past year. This competitive dynamic not only fosters innovation but also encourages operators to adopt the latest technologies, thereby enhancing the overall quality of 4g lte services available to consumers.

Technological Advancements in Network Equipment

Technological advancements in network equipment are playing a crucial role in shaping the 4g lte market. Innovations in hardware and software solutions are enabling telecom operators to optimize their networks for better performance and efficiency. For instance, the introduction of advanced antennas and MIMO (Multiple Input Multiple Output) technology has significantly improved data throughput and network capacity. As a result, operators are likely to invest heavily in upgrading their existing infrastructure to support these advancements. According to industry estimates, the US telecom sector is expected to allocate over $30 billion towards network upgrades by 2026, which will directly impact the growth trajectory of the 4g lte market.