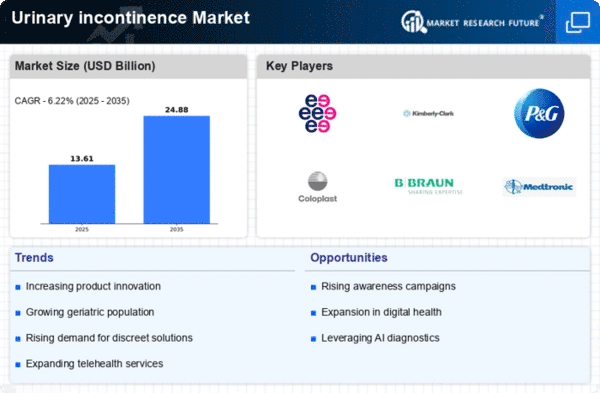

Market Growth Projections

The Global Urinary Incontinence Market Industry is projected to experience robust growth in the coming years. By 2024, the market is expected to reach 3.27 USD Billion, with further growth anticipated to 5 USD Billion by 2035. This trajectory indicates a compound annual growth rate of 3.94% from 2025 to 2035. Such projections highlight the increasing demand for urinary incontinence solutions, driven by factors such as technological advancements, demographic shifts, and heightened awareness. The market's expansion reflects the urgent need for effective management strategies to address the challenges faced by individuals living with urinary incontinence.

Growing Geriatric Population

The global increase in the geriatric population is a significant factor influencing the Global Urinary Incontinence Market Industry. As individuals age, the likelihood of experiencing urinary incontinence rises due to physiological changes and comorbidities. According to demographic projections, the number of people aged 65 and older is expected to double by 2050, creating a larger market for urinary incontinence solutions. This demographic shift is likely to drive demand for various products, including absorbent pads, medications, and surgical interventions. Consequently, the market is poised for substantial growth as the needs of this aging population become more pronounced.

Increased Awareness and Education

Increased awareness and education regarding urinary incontinence are crucial drivers of the Global Urinary Incontinence Market Industry. Public health campaigns and educational initiatives are helping to destigmatize the condition, encouraging individuals to seek urinary incontinence treatment. This shift in perception is vital, as many people suffer in silence due to embarrassment. As awareness grows, more individuals are likely to consult healthcare professionals, leading to higher demand for products and services. This trend is expected to contribute to a compound annual growth rate of 3.94% from 2025 to 2035, as more people recognize the importance of addressing urinary incontinence.

Rising Prevalence of Urinary Incontinence

The increasing prevalence of urinary incontinence among various demographics is a primary driver of the Global Urinary Incontinence Market Industry. Factors such as aging populations, obesity, and chronic conditions contribute to this rise. For instance, it is estimated that by 2024, the market will reach 3.27 USD Billion, reflecting the growing need for effective management solutions. The World Health Organization indicates that urinary incontinence affects a significant portion of older adults, with prevalence rates ranging from 15 to 30%. This trend underscores the urgency for innovative products and services tailored to address the needs of affected individuals.

Comprehensive care involves pelvic floor muscle training, bladder training, lifestyle modifications, skin care, and emotional support. With proper treatment and care, individuals with urinary incontinence can significantly improve their quality of life and daily confidence.

Regulatory Support and Reimbursement Policies

Regulatory support and favorable reimbursement policies are essential drivers of the Global Urinary Incontinence Market Industry. Governments and health organizations are increasingly recognizing the need for effective management of urinary incontinence, leading to the establishment of supportive frameworks. For instance, many countries are implementing reimbursement policies that cover the costs of urinary incontinence treatments and products for urinary incontinence. This support not only alleviates the financial burden on patients but also encourages manufacturers to innovate and expand their offerings. As a result, the market is likely to experience sustained growth, driven by these favorable conditions.

Advancements in Urinary incontinence Treatment Technologies

Technological advancements in treatment options for urinary incontinence are propelling the Global Urinary Incontinence Market Industry forward. Innovations such as minimally invasive surgical techniques, neuromodulation therapies, and advanced absorbent products are enhancing patient outcomes. For example, the introduction of new devices and surgical methods has improved efficacy and reduced recovery times. As a result, the market is projected to grow to 5 USD Billion by 2035, driven by these advancements. Furthermore, ongoing research and development efforts are likely to yield even more effective solutions, thereby expanding the market and improving quality of life for patients.

Medications for urinary incontinence are primarily used to treat overactive bladder and urge incontinence. These include anticholinergic drugs and beta-3 adrenergic agonists, which help relax the bladder muscles, reduce sudden urges, and improve bladder control. In some cases, hormone therapy or botulinum toxin injections may also be recommended.

Urinary incontinence devices play an important role in symptom management. These include urethral inserts, pessaries, external catheters, absorbent pads, and advanced neuromodulation devices that help regulate bladder nerve signals. Such devices provide non-surgical options for improved comfort and independence

Leave a Comment