Market Analysis

In-depth Analysis of Urinary incontinence Market Industry Landscape

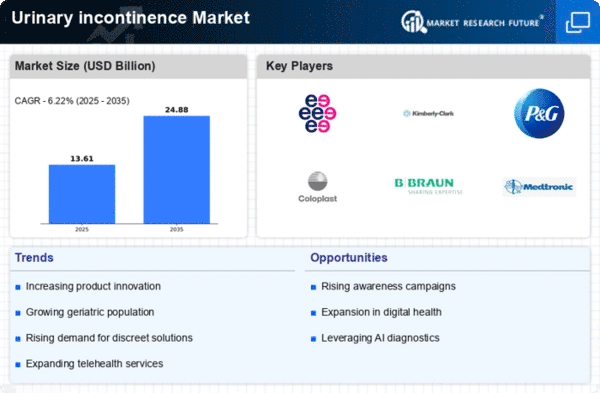

There is a market for products that help people who leak urine that is growing and moving the fastest in the healthcare business. This is a sickness in which people leak urine without being able to stop it. Millions of people around the world are thought to have it. A lot of people of all ages can get this sickness. More and more people are having trouble holding their urine. This is taking place because people are living longer, becoming more aware of the issue, and altering the way they live. One of the most important changes in the market right now is this. As people live longer, more and more of them will have to deal with accidents where they leak urine. This will create a large market for new medicines, which will be driven by the need for them. With the help of new technology, it is now possible to find and treat urine leaks in new ways. All of these changes are possible because of new tools. They would not be possible without them. There are a lot of methods that claim to get to the bottom of leaks that people are very interested in. It looks like this trend will continue. The market for urine incontinence is rising around the world as more people learn about health care and budgets in poor countries get better. Everywhere in the world, you can see this growth. People in the market are spending money and looking in places that haven't been fully explored yet. This is because they want to find answers that are cheap and easy to get to. Researchers, companies that make medical equipment, and drug makers work together and agree on long-term goals. These ties have something to do with how the market changes. Each member of these partnerships brings their own knowledge and resources to the table so that everyone can work together to make new tools and drugs faster. It's tough to tell the difference between the markets for urine leaking goods and healthcare funds. How well people accept new drugs and tools in the market depends a lot on how payment policies change over time. Now the market is moving in a different way, and people can choose from better choices. There is a clear shift in the market for urine leakage toward a method that doesn't care as much about the patient. Over the past few years, companies have paid more attention to what their patients want and need. This has led to the creation of more personalized and simple-to-use items. A lot of companies that make drugs and medical tools are competing in the market for people who leak urine. The market is becoming more stable thanks to more mergers and acquisitions, which is one of the most important changes in this field. For businesses, following this trend can help them sell more goods and move up in the market. People want answers that are both good value for money and work well when put into action, so the market changes. Companies have to make things that work well in business settings and don't cost too much because they need to cut costs. It will be easy for people all over the world to get drugs after this change.

Leave a Comment