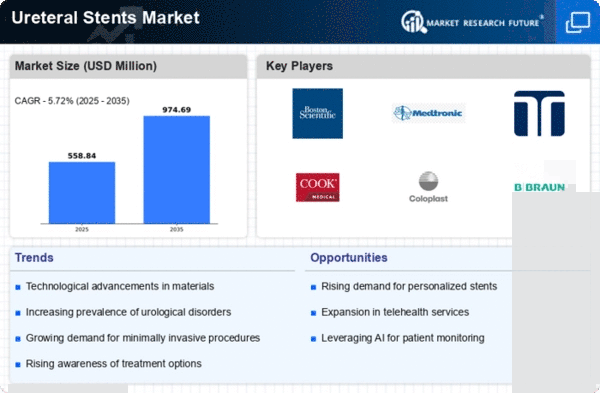

Market Growth Projections

The Global Ureteral Stents Market Industry is projected to experience substantial growth over the next decade. With an estimated market value of 0.53 USD Billion in 2024, it is expected to reach approximately 0.97 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate (CAGR) of 5.67% from 2025 to 2035, driven by factors such as increasing urological disorders, technological advancements, and enhanced healthcare access. The market's expansion reflects the growing recognition of the importance of effective urological treatments and the ongoing innovations in ureteral stent design and application.

Technological Advancements in Stent Design

Innovations in ureteral stent technology significantly enhance their effectiveness and patient comfort. Developments such as biocompatible materials and advanced coatings reduce complications like encrustation and infection. The Global Ureteral Stents Market Industry benefits from these advancements, as they lead to improved patient outcomes and satisfaction. As healthcare providers increasingly adopt these advanced stents, the market is projected to grow. The anticipated compound annual growth rate (CAGR) of 5.67% from 2025 to 2035 indicates a robust demand for technologically superior ureteral stents, which are becoming essential in modern urological practices.

Increasing Incidence of Urological Disorders

The rising prevalence of urological disorders globally drives the demand for ureteral stents. Conditions such as kidney stones and urinary obstructions necessitate the use of stents for effective management. In 2024, the Global Ureteral Stents Market Industry is valued at approximately 0.53 USD Billion, reflecting the growing need for these medical devices. As the population ages and lifestyle factors contribute to urological issues, the market is expected to expand. This trend suggests a sustained increase in the adoption of ureteral stents, which are crucial for alleviating symptoms and preventing complications associated with these disorders.

Regulatory Support and Reimbursement Policies

Supportive regulatory frameworks and favorable reimbursement policies play a crucial role in the growth of the Global Ureteral Stents Market Industry. Governments and health authorities are increasingly recognizing the importance of urological health, leading to policies that facilitate the approval and reimbursement of ureteral stents. This regulatory environment encourages manufacturers to innovate and expand their product offerings. As reimbursement rates improve, healthcare providers are more likely to adopt ureteral stents as a standard treatment option, thereby driving market growth. The anticipated increase in market value to 0.97 USD Billion by 2035 reflects this positive trend.

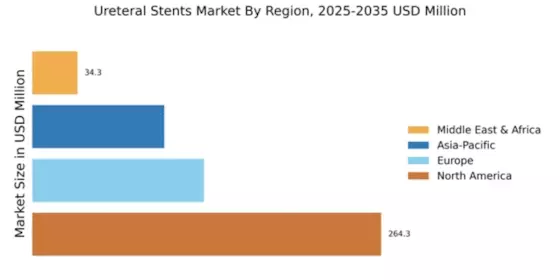

Growth in Healthcare Infrastructure and Access

The expansion of healthcare infrastructure globally facilitates better access to urological treatments, including ureteral stenting procedures. As hospitals and clinics enhance their capabilities, the Global Ureteral Stents Market Industry is poised for growth. Increased investment in healthcare facilities, particularly in developing regions, allows for more comprehensive urological care. This improved access is likely to result in higher rates of stent placements, as more patients can receive timely interventions for urological disorders. The market's growth trajectory is supported by these infrastructural developments, which aim to meet the rising demand for effective urological solutions.

Rising Awareness and Education on Urological Health

Increased awareness regarding urological health among the general population contributes to the growth of the Global Ureteral Stents Market Industry. Educational campaigns by healthcare organizations promote early diagnosis and treatment of urological conditions, leading to higher rates of stent utilization. As patients become more informed about their health options, they are more likely to seek medical intervention for issues that may require stenting. This trend is expected to drive market growth, as proactive healthcare measures lead to a higher demand for ureteral stents, ultimately improving patient outcomes and quality of life.