Rising Geriatric Population

The increasing geriatric population is a significant factor driving the Surgical Stents Market. As individuals age, they are more susceptible to various health conditions, including cardiovascular diseases, which often require surgical intervention. The World Health Organization projects that the number of people aged 60 years and older will double by 2050, leading to a higher demand for surgical stents. This demographic shift necessitates the development of specialized stenting solutions tailored to the unique needs of older patients. Consequently, the Surgical Stents Market is likely to experience robust growth as healthcare providers focus on addressing the challenges posed by an aging population.

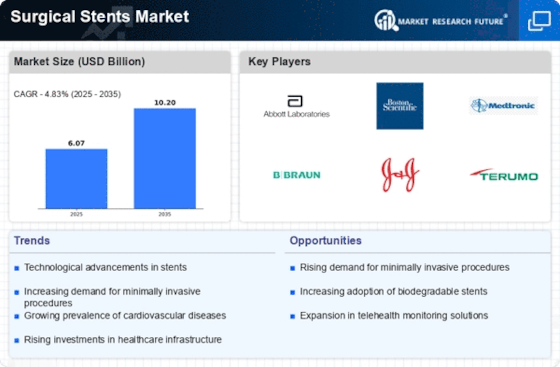

Technological Innovations in Stent Design

Technological advancements in stent design and materials are significantly influencing the Surgical Stents Market. Innovations such as drug-eluting stents and bioresorbable stents are enhancing the efficacy and safety of procedures. These advancements not only improve patient outcomes but also reduce the risk of complications associated with traditional stents. The introduction of new materials, such as polymers and metals, has led to stents that are more durable and biocompatible. As a result, healthcare providers are increasingly adopting these advanced stents, contributing to market growth. The Surgical Stents Market is poised for further expansion as ongoing research and development efforts yield even more sophisticated stent technologies.

Regulatory Support and Reimbursement Policies

Supportive regulatory frameworks and favorable reimbursement policies are crucial drivers of the Surgical Stents Market. Governments and health authorities are increasingly recognizing the importance of stenting procedures in managing cardiovascular diseases, leading to streamlined approval processes for new stent technologies. Furthermore, reimbursement policies that cover the costs of stenting procedures encourage healthcare providers to adopt these interventions. This regulatory environment fosters innovation and investment in the Surgical Stents Market, as companies are motivated to develop new products that meet regulatory standards and address patient needs. As a result, the market is likely to see continued growth in the coming years.

Increasing Prevalence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases is a primary driver for the Surgical Stents Market. As populations age and lifestyle-related health issues become more prevalent, the demand for effective treatment options escalates. According to recent data, cardiovascular diseases account for a substantial percentage of global mortality rates, necessitating the use of surgical stents for interventions such as angioplasty. This trend indicates a growing market for stents, as healthcare providers seek to address the needs of patients with coronary artery disease and other related conditions. The Surgical Stents Market is likely to expand as healthcare systems adapt to these challenges, investing in advanced stenting technologies to improve patient outcomes.

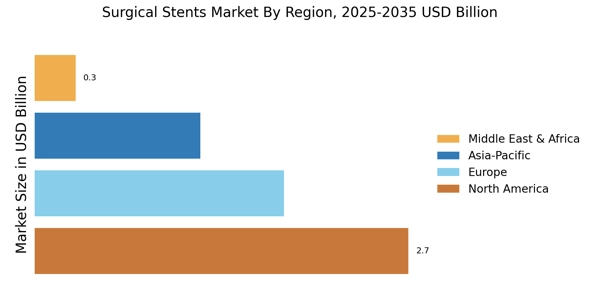

Growing Awareness and Accessibility of Healthcare

Increased awareness of health issues and improved access to healthcare services are propelling the Surgical Stents Market. As patients become more informed about treatment options for cardiovascular diseases, the demand for surgical stents rises. Additionally, advancements in healthcare infrastructure and insurance coverage are making these procedures more accessible to a broader population. This trend is particularly evident in emerging markets, where healthcare systems are evolving to meet the needs of their citizens. The Surgical Stents Market is expected to benefit from this growing awareness and accessibility, as more patients seek timely interventions for their health concerns.