Growing Aging Population

The aging population in France is a notable driver for the sleep apnea-devices market. As individuals age, the likelihood of developing sleep apnea increases due to physiological changes and comorbidities. With approximately 20% of the population aged 65 and older, the demand for sleep apnea devices is expected to rise correspondingly. This demographic shift necessitates targeted healthcare solutions, including effective sleep apnea management. The sleep apnea-devices market is likely to see a significant uptick in demand as healthcare providers focus on addressing the needs of older adults. Projections suggest that the market could grow by 10% over the next five years, driven by this demographic trend.

Increased Healthcare Expenditure

The rise in healthcare expenditure in France is a significant driver for the sleep apnea-devices market. With the French government investing heavily in healthcare infrastructure and services, there is a growing focus on preventive care and chronic disease management. This shift is likely to enhance access to sleep apnea diagnosis and treatment options. As healthcare budgets increase, more resources are allocated to the procurement of medical devices, including those for sleep apnea. The sleep apnea-devices market could benefit from this trend, as hospitals and clinics are more likely to invest in advanced technologies to improve patient outcomes. It is estimated that healthcare spending in France could rise by 4% annually, positively impacting the market.

Innovations in Device Technology

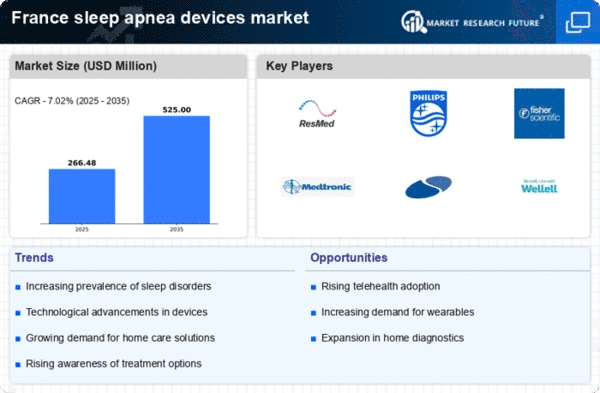

Innovations in technology are significantly influencing the sleep apnea-devices market. The introduction of advanced devices, such as auto-adjusting CPAP machines and portable monitoring systems, enhances patient comfort and compliance. These technological advancements not only improve the efficacy of treatments but also cater to the growing demand for user-friendly solutions. In France, the market is witnessing a shift towards smart devices that integrate with mobile applications, allowing for real-time monitoring and data analysis. This trend is expected to attract a younger demographic, further expanding the market. The potential for these innovations to reduce the burden of sleep apnea could lead to an increase in market value, projected to reach €1 billion by 2027.

Rising Prevalence of Sleep Disorders

The increasing prevalence of sleep disorders in France is a critical driver for the sleep apnea-devices market. Recent studies indicate that approximately 4 million individuals in France suffer from sleep apnea, a condition that often goes undiagnosed. This rising number of cases necessitates the development and distribution of effective sleep apnea devices. As awareness grows regarding the health risks associated with untreated sleep apnea, including cardiovascular diseases and diabetes, the demand for these devices is likely to surge. The sleep apnea-devices market is expected to expand as healthcare providers emphasize the importance of diagnosis and treatment, potentially leading to a market growth rate of around 8% annually in the coming years.

Rising Consumer Awareness and Education

Rising consumer awareness and education regarding sleep health are pivotal drivers for the sleep apnea-devices market. Increased access to information through digital platforms and healthcare campaigns has led to a better understanding of sleep apnea and its implications. As individuals become more informed about the symptoms and risks associated with sleep disorders, they are more likely to seek diagnosis and treatment. This heightened awareness is fostering a proactive approach to health, resulting in increased demand for sleep apnea devices. The sleep apnea devices market is expected to benefit from this trend, with an anticipated growth rate of 7% as more consumers prioritize their sleep health and seek effective solutions.