Growing Legal Environment

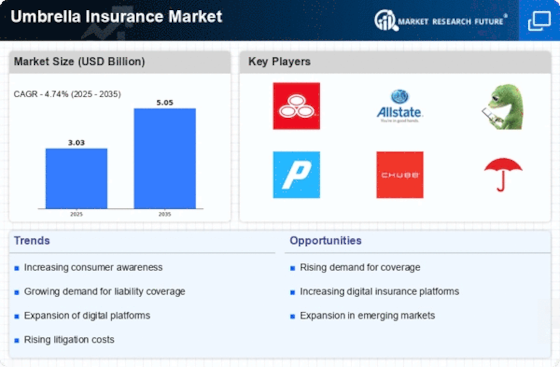

The increasing complexity of the legal environment appears to be a significant driver for the Umbrella Insurance Market. As litigation becomes more prevalent, individuals and businesses are more likely to face lawsuits that exceed their primary insurance coverage limits. This trend suggests a rising demand for umbrella insurance policies, which provide additional liability coverage. According to recent data, the average cost of legal defense can reach thousands of dollars, prompting consumers to seek higher coverage limits. The Umbrella Insurance Market is likely to benefit from this growing awareness, as policyholders recognize the necessity of safeguarding their assets against potential legal claims.

Enhanced Consumer Education

Consumer education regarding the importance of liability coverage is increasingly influencing the Umbrella Insurance Market. As insurance providers invest in educational initiatives, potential customers are becoming more informed about the risks associated with inadequate coverage. This heightened awareness may lead to an uptick in policy purchases, as individuals and families seek to protect their financial futures. Recent surveys indicate that a significant percentage of consumers are unaware of the benefits of umbrella insurance, suggesting a substantial opportunity for growth within the market. The Umbrella Insurance Market could see a surge in demand as more consumers recognize the value of comprehensive liability protection.

Economic Growth and Wealth Accumulation

Economic growth and the corresponding increase in personal and business wealth are likely to drive the Umbrella Insurance Market. As individuals accumulate more assets, the need for additional liability coverage becomes more pronounced. Data indicates that high-net-worth individuals are particularly inclined to invest in umbrella insurance to protect their wealth from unforeseen liabilities. This trend suggests that as economies continue to recover and expand, the demand for umbrella insurance policies will likely rise. The Umbrella Insurance Market stands to gain from this correlation between wealth accumulation and the necessity for enhanced liability protection.

Technological Advancements in Insurance

Technological advancements are reshaping the Umbrella Insurance Market by streamlining the purchasing process and enhancing customer experience. Insurers are increasingly utilizing digital platforms to offer personalized quotes and coverage options, making it easier for consumers to understand their insurance needs. This shift towards technology-driven solutions may attract a younger demographic, who are more inclined to engage with digital tools. Furthermore, data analytics allows insurers to better assess risk, potentially leading to more competitive pricing. As technology continues to evolve, the Umbrella Insurance Market is likely to experience growth driven by improved accessibility and customer engagement.

Regulatory Changes and Compliance Requirements

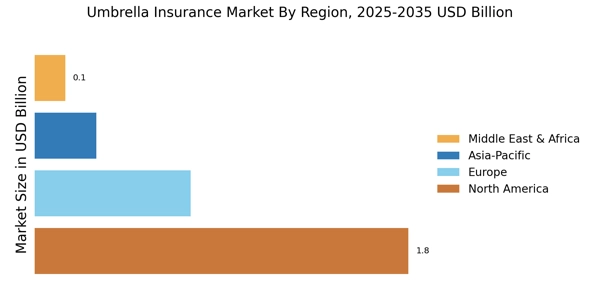

Regulatory changes and evolving compliance requirements are influencing the Umbrella Insurance Market. As governments implement stricter liability laws, individuals and businesses may find themselves needing additional coverage to meet these new standards. This trend indicates a potential increase in demand for umbrella insurance policies, as policyholders seek to ensure compliance while protecting their assets. Recent legislative changes in various regions have highlighted the importance of adequate liability coverage, suggesting that the Umbrella Insurance Market could see a rise in policy uptake as consumers adapt to these regulatory shifts.