Market Growth Projections

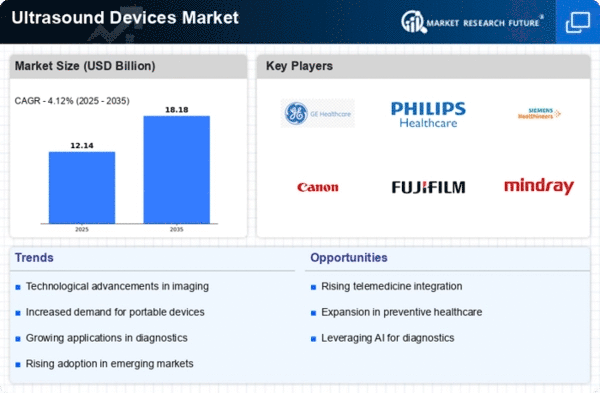

The Global Ultrasound Devices Market Industry is poised for substantial growth, with projections indicating a market size of 8.02 USD Billion in 2024, expanding to 15.2 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 5.98% from 2025 to 2035. Such figures reflect the increasing adoption of ultrasound technology across various medical applications, driven by factors such as technological advancements, rising chronic disease prevalence, and an aging population. The market's expansion is indicative of the critical role ultrasound devices play in modern healthcare.

Technological Advancements

The Global Ultrasound Devices Market Industry is experiencing rapid technological advancements that enhance imaging quality and diagnostic capabilities. Innovations such as 3D and 4D ultrasound technologies are becoming increasingly prevalent, allowing for more detailed visualization of anatomical structures. These advancements not only improve patient outcomes but also expand the applications of ultrasound in various medical fields, including obstetrics, cardiology, and musculoskeletal imaging. As a result, the market is projected to grow from 8.02 USD Billion in 2024 to 15.2 USD Billion by 2035, indicating a robust demand driven by these technological improvements.

Growing Geriatric Population

An aging global population is contributing to the growth of the Global Ultrasound Devices Market Industry. As individuals age, the likelihood of developing health issues increases, necessitating regular medical check-ups and imaging procedures. Ultrasound devices are particularly beneficial for elderly patients due to their non-invasive nature and ease of use. The World Health Organization projects that the number of people aged 60 years and older will reach 2.1 billion by 2050, creating a substantial demand for ultrasound services. This demographic shift is likely to drive market growth as healthcare systems adapt to meet the needs of an older population.

Government Initiatives and Funding

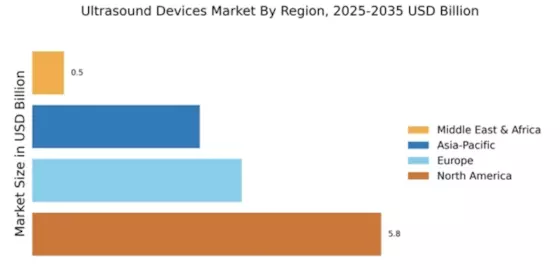

Government initiatives aimed at improving healthcare infrastructure and access to diagnostic tools are playing a pivotal role in the Global Ultrasound Devices Market Industry. Many countries are investing in healthcare reforms that prioritize the availability of advanced medical technologies, including ultrasound devices. Funding programs and public health campaigns are designed to enhance diagnostic capabilities in underserved regions, thereby increasing the adoption of ultrasound technology. This supportive environment is likely to foster market growth, as investments in healthcare infrastructure are projected to rise significantly in the coming years.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases globally is a significant driver for the Global Ultrasound Devices Market Industry. Conditions such as cardiovascular diseases, diabetes, and cancer necessitate regular monitoring and diagnostic imaging, where ultrasound plays a crucial role. The ability of ultrasound to provide real-time imaging without the use of ionizing radiation makes it a preferred choice for both patients and healthcare providers. This growing need for non-invasive diagnostic tools is expected to contribute to the market's expansion, with a projected compound annual growth rate of 5.98% from 2025 to 2035.

Rising Demand for Point-of-Care Ultrasound

The Global Ultrasound Devices Market Industry is witnessing a shift towards point-of-care ultrasound (POCUS), which allows for immediate diagnostic imaging at the site of patient care. This trend is driven by the need for rapid decision-making in clinical settings, particularly in emergency medicine and critical care. POCUS enhances patient management by providing timely information, which can lead to better health outcomes. As healthcare providers increasingly adopt portable and user-friendly ultrasound devices, the market is expected to expand significantly, aligning with the overall growth trajectory of the industry.