Market Trends

Key Emerging Trends in the Ultrasound Devices Market

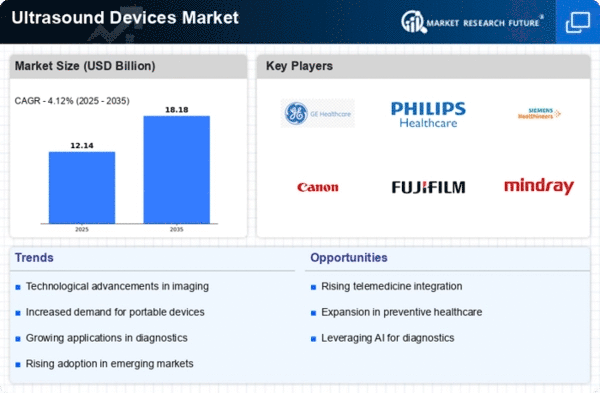

The market is seeing a surge in demand for portable ultrasound devices, driven by the requirement for adaptability and portability in healthcare settings. Reduced and lightweight ultrasound devices empower healthcare professionals to lead imaging learns at the bedside, in distant areas, and during clinical effort drives. The reception of three-dimensional (3D) and four-dimensional (4D) ultrasound imaging is expanding across different clinical claims to fame, offering upgraded representation of physical designs and dynamic developments. Obstetrics, gynecology, and outer muscle imaging, specifically, benefit from the better symptomatic abilities of 3D/4D ultrasound. Artificial Intelligence (AI) is assuming an undeniably crucial part in ultrasound diagnostics. AI calculations aid picture examination, working on the precision and productivity of indicative translations. Robotized estimations, design acknowledgment, and choice emotionally supportive networks are becoming basic parts of ultrasound devices. Handheld ultrasound devices are gaining prevalence, especially in crisis and essential care settings. These devices offer compactness and usability, permitting healthcare providers to perform speedy sweeps for starter evaluations. The conservative idea of handheld ultrasound devices adds to their adaptability and availability. Past analytic imaging, ultrasound is tracking down new applications in restorative mediations. High-intensity focused ultrasound (HIFU) is being used for non-invasive therapy of certain circumstances, like uterine fibroids and prostate cancer. This pattern addresses a union of imaging and helpful capacities in ultrasound devices. The reception of telemedicine and distant healthcare administrations has moved the utilization of ultrasound devices in virtual discussions. Portable and handheld ultrasound devices work with far off demonstrative imaging, empowering healthcare professionals to survey patients continuously, even in physically far off areas.

Leave a Comment