Advancements in Network Automation

Advancements in network automation technology are significantly impacting the virtual network-functions market. The increasing complexity of network environments necessitates automated solutions that can streamline operations and enhance performance. In the UK, businesses are adopting automation tools to manage their virtual network functions more effectively. This trend is supported by the growing availability of sophisticated software solutions that facilitate automation. As organisations seek to improve their network management capabilities, the integration of automation into virtual network functions is expected to drive market growth. The potential for reduced manual intervention and improved service delivery positions automation as a key driver in the evolving landscape of the virtual network-functions market.

Regulatory Compliance and Standards

The virtual network-functions market is also influenced by the need for regulatory compliance and adherence to industry standards. In the UK, businesses are increasingly required to meet stringent regulations regarding data protection and network security. This necessity drives the demand for virtual network functions that can ensure compliance while maintaining operational efficiency. The market is witnessing a shift towards solutions that not only provide functionality but also incorporate compliance features. As organisations navigate the complexities of regulatory frameworks, the ability to deploy compliant virtual network functions is likely to become a critical factor in their decision-making processes, thereby shaping the market dynamics.

Growing Demand for Network Flexibility

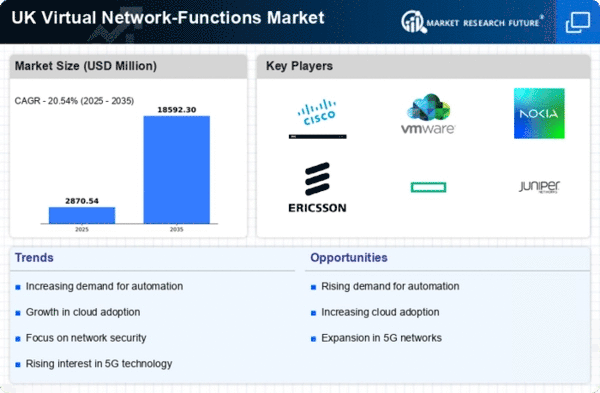

The virtual network-functions market is experiencing a notable surge in demand for network flexibility. Businesses in the UK are increasingly seeking solutions that allow for rapid deployment and scalability of network services. This shift is driven by the need to adapt to changing market conditions and customer requirements. According to recent data, the market is projected to grow at a CAGR of approximately 15% over the next five years. This growth indicates a strong inclination towards virtual network functions that can be easily modified and expanded. As companies strive to enhance their operational efficiency, the adoption of virtual network functions is likely to become a cornerstone of their network strategies, thereby propelling the market forward.

Cost Efficiency and Resource Optimization

Cost efficiency remains a pivotal driver in the virtual network-functions market. UK enterprises are increasingly recognising the financial benefits associated with virtualising network functions. By transitioning from traditional hardware-based solutions to virtualised environments, organisations can significantly reduce capital expenditures and operational costs. Reports suggest that businesses can save up to 30% on infrastructure costs by implementing virtual network functions. This financial incentive is compelling, particularly for small to medium-sized enterprises that may have limited budgets. As the market continues to evolve, the emphasis on cost-effective solutions is expected to drive further adoption of virtual network functions, enhancing the overall market landscape.

Rising Demand for Enhanced Security Solutions

The virtual network-functions market is witnessing a rising demand for enhanced security solutions. As cyber threats become increasingly sophisticated, UK organisations are prioritising the implementation of robust security measures within their network infrastructures. Virtual network functions offer the flexibility to integrate advanced security features, such as firewalls and intrusion detection systems, directly into the network architecture. This capability is particularly appealing to businesses looking to safeguard sensitive data and maintain compliance with regulatory requirements. The market is expected to see a substantial increase in the adoption of security-focused virtual network functions, reflecting the growing awareness of the importance of cybersecurity in today's digital landscape.